|

|

|

|

|

|

|

CHAPTER 1 – GOALS AND

OBJECTIVES.............................................................................1-1

|

|

INTRODUCTION.............................................................................................................................

1-1 |

|

GENERAL GUIDELINES ..................................................................................................................

1-1 |

|

KEY ISSUES...................................................................................................................................

1-2 |

|

GOALS

AND OBJECTIVES ...............................................................................................................

1-3 Goal No.

1.......................................................................................................................................................

1-4 Goal No.

2.......................................................................................................................................................

1-4 Goal No.

3.......................................................................................................................................................

1-5 Goal No.

4.......................................................................................................................................................

1-5 Goal No. 5.......................................................................................................................................................

1-6 Goal No.

6.......................................................................................................................................................

1-6 Goal No.

7.......................................................................................................................................................

1-7 Goal No.

8.......................................................................................................................................................

1-7 |

|

REGULATORY GUIDELINES ...........................................................................................................

1-8 Water

Quality..................................................................................................................................................

1-8 Historical,

Architectural, Archaeological, and Cultural Resources

............................................................... 1-9 Biotic

Communities.........................................................................................................................................

1-9 Endangered and Threatened Species

.............................................................................................................

1-10 Wetlands.........................................................................................................................................................

1-10 Floodplains ....................................................................................................................................................

1-11 Coastal Zone Management Program

.............................................................................................................

1-11 Farmland........................................................................................................................................................

1-12 |

|

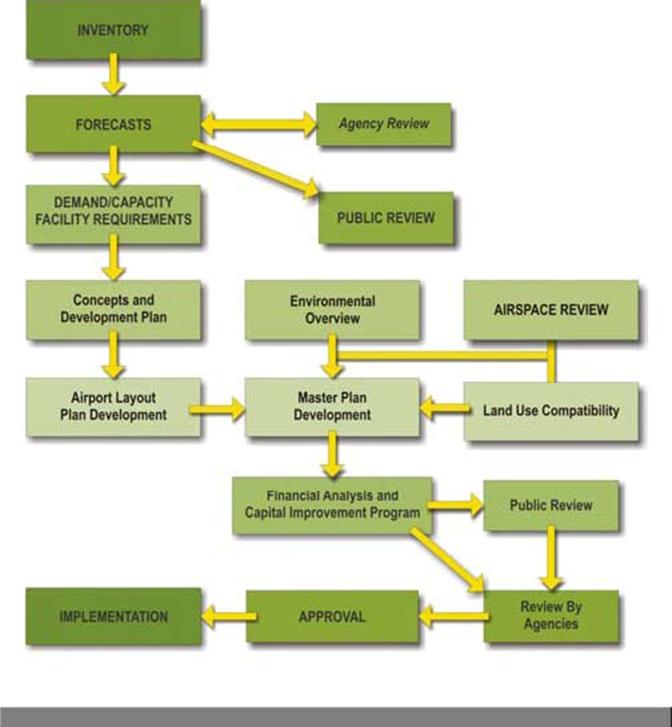

MASTER PLANNING PROCESS ......................................................................................................

1-12 |

|

CHAPTER 2 – EXISTING CONDITIONS

...............................................................................

2-1 |

|

FORWARD.....................................................................................................................................

2-1 |

|

AIRPORT SETTING .........................................................................................................................

2-2 Climate............................................................................................................................................................

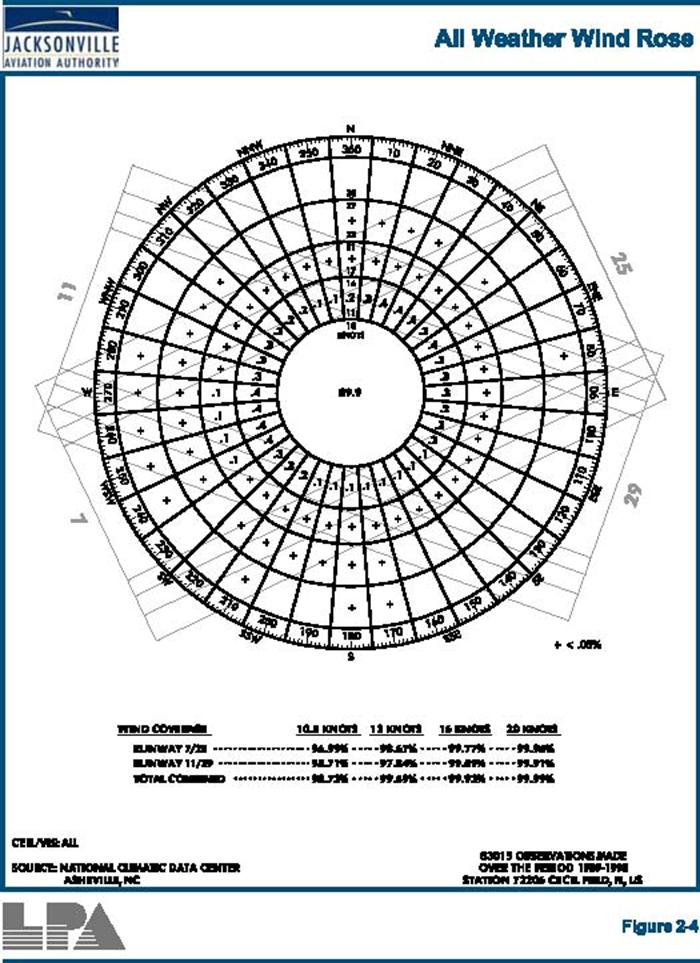

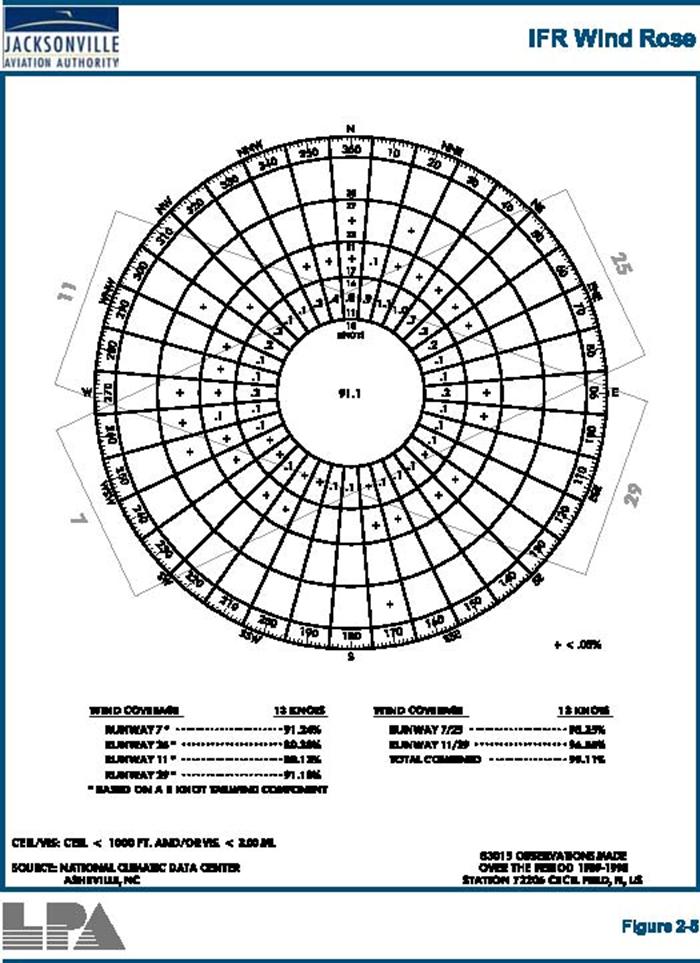

2-7 Wind Coverage

................................................................................................................................................

2-7 FAA Certification and

Classification.............................................................................................................

2-11 |

|

HISTORIC DATA ...........................................................................................................................2-12

Airport

History...............................................................................................................................................

2-12 Airport

Acreage..............................................................................................................................................

2-12 Previous Studies and

Reports.........................................................................................................................

2-13 |

|

ROLE OF AIRPORT .......................................................................................................................

2-13 Jacksonville

Airport Authority Plan/Duval County System Plans

................................................................. 2-13 Florida Aviation System Plans

(FASP)

..........................................................................................................2-13

National Plan of Integrated Airport Systems

(NPIAS)....................................................................................2-14

|

|

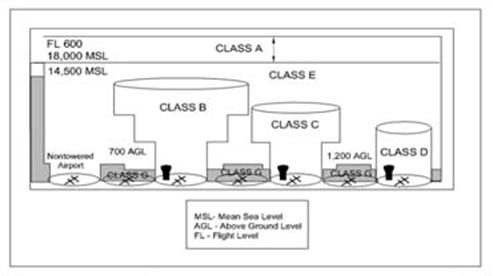

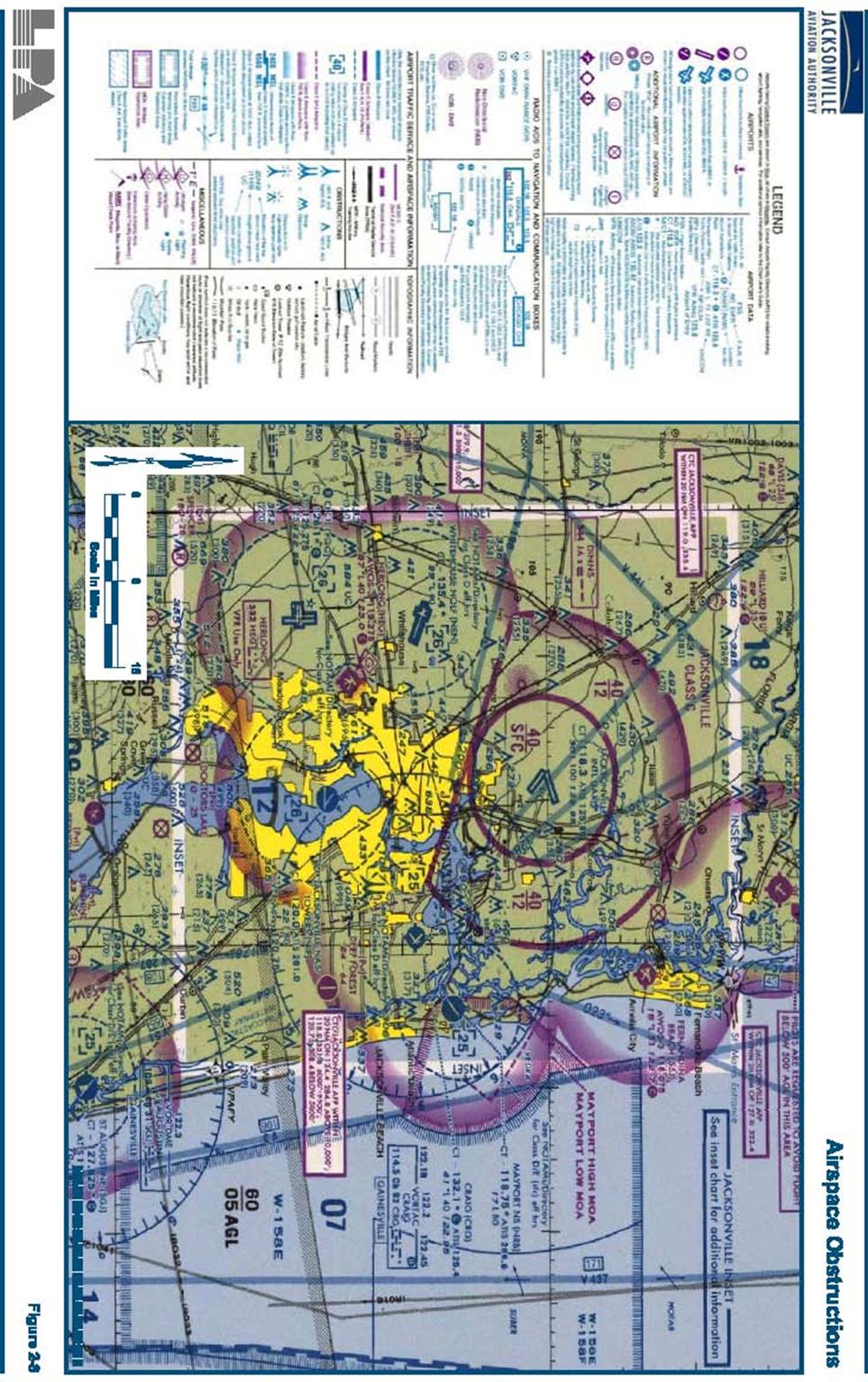

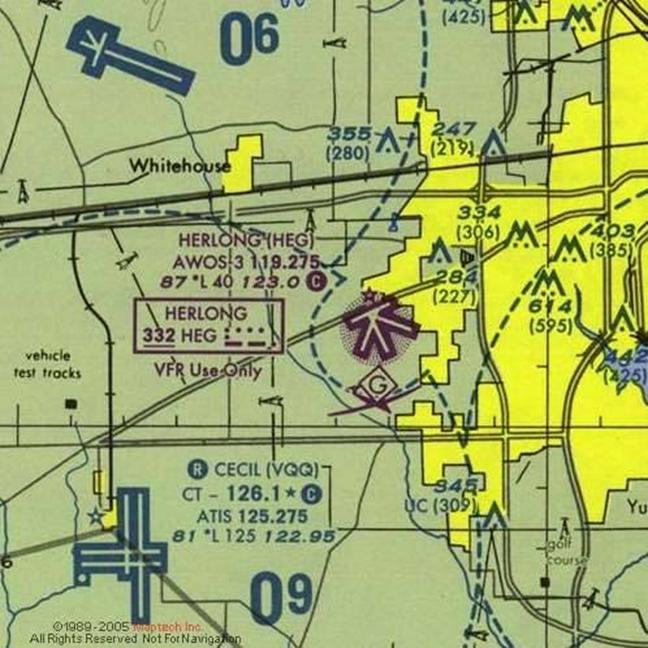

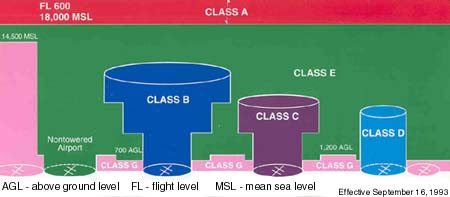

AIR

TRAFFIC CONTROL AND AIRSPACE STRUCTURE ....................................................................

2-15 Special Use

Airspace

......................................................................................................................................2-16 Traffic

Pattern.................................................................................................................................................2-18

|

|

|

|

|

|

General Airport

Information...........................................................................................................................2-18 FAR Part 77 Surfaces –

Obstructions to Navigable

Airspace.........................................................................2-21

|

|

EXISTING AIRSIDE FACILITIES .....................................................................................................

2-22 Approach &

Navigational

Aids.......................................................................................................................2-23 Runways

..........................................................................................................................................................2-26

Taxiways

.........................................................................................................................................................2-27

Aircraft Apron

Facilities.................................................................................................................................2-28

|

|

EXISTING LANDSIDE FACILITIES..................................................................................................

2-29 Land Use

.........................................................................................................................................................2-29 FBO Terminal Facilities

.................................................................................................................................2-30

Surface Transportation Network.....................................................................................................................2-34

Automobile Parking

........................................................................................................................................2-34

|

|

AIRCRAFT FACILITIES ... .………………………………………………………………………. 2-35 T-Hangar

Facilities.....................................................................................

................................................... 2-35 Tenant

Facilities................................................................................................

............................................. 2-35 Off Airport

Facilities.......................................................................................

............................................... 2-36 |

|

SUPPORT FACILITIES...................................................................................................................

2-36 Fixed Base

Operator.......................................................................................................................................2-37 Fuel Facilities

.................................................................................................................................................2-37

Security ...........................................................................................................................................................2-37

Aircraft

Washrack...........................................................................................................................................2-39

Aircraft Rescue and Fire Fighting

..................................................................................................................2-39

|

|

PUBLIC UTILITIES........................................................................................................................

2-40 |

|

STORMWATER DRAINAGE ............................................................................................................2-40

|

|

EXISTING

ENVIRONMENTAL CONDITIONS....................................................................................

2-40 Water

Quality.....................................................................................

............................................................ 2-40 Historical, Architectural,

Archaeological & Cultural Resources...................

............................................... 2-41 Biotic

Communities.........................................................................................................................................

2-41 Endangered and Threatened

Species..............................................................................................................

2-43 Wetlands..............................................................................................

........................................................... 2-51 Floodplains.....................................................................................................................................................

2-54 Coastal Zone Management

Program..............................................................................................................

2-54 Farmland..............................................................................................

.......................................................... 2-54 |

|

SUMMARY OF EXISTING CONDITIONS..........................................................................................

2-56 |

|

CHAPTER 3 – AVIATION ACTIVITY FORECASTS

............................................................ 3-1 |

|

INTRODUCTION

AND BACKGROUND..............................................................................................

3-1 Historical

Sources...........................................................................................................................................

3-2 Methodology

...................................................................................................................................................

3-2 Historic Data

..................................................................................................................................................

3-3 Historic Based Aircraft

...................................................................................................................................

3-4 Historic Annual Aircraft

Operations...............................................................................................................

3-5 Previous Aviation Activity Forecasts

..............................................................................................................

3-6 |

|

FORECASTING APPROACH ...........................................................................................................

3-10 Industry Trends and

Impacts of September 11,

2001.....................................................................................

3-11 |

|

FORECAST OF BASED AIRCRAFT..................................................................................................

3-13 |

|

|

|

|

|

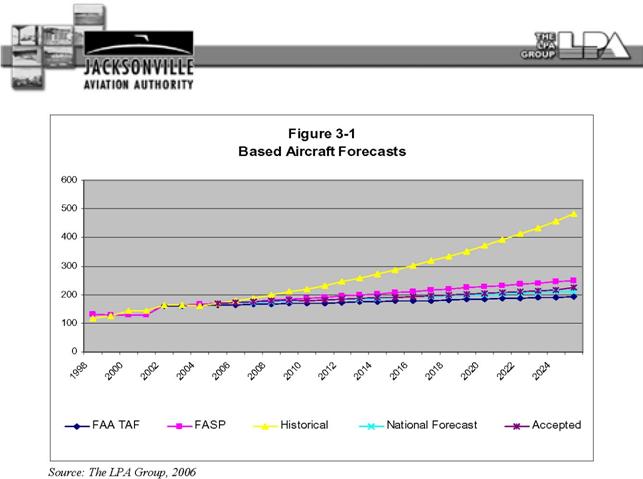

Aircraft Using FAA TAF Growth

Rate...........................................................................................................

3-13 Projection of

Based Aircraft Using

FASP......................................................................................................

3-14 Projection of Based Aircraft Using Historical

Growth..................................................................................

3-14 Projection of Based Aircraft Using National Forecast

Projections............................................................... 3-14

Selected Based Aircraft Forecast (Used Average Growth Rate of 1.39%)

.................................................... 3-14 Projected

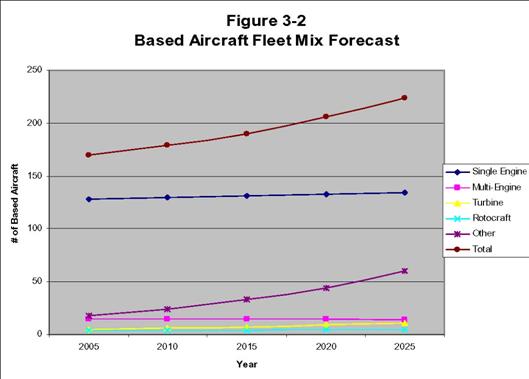

Based Aircraft Fleet Mix

...............................................................................................................

3-16 |

|

FORECAST

OF AIRCRAFT OPERATIONS.........................................................................................

3-20 Forecast of GA

(Non-Military) Aircraft

Operations......................................................................................

3-20 Military

Operations........................................................................................................................................

3-23 Local Versus Itinerant Split

...........................................................................................................................

3-24 Instrument Operations Forecast

....................................................................................................................

3-25 Peak Activity Forecast ...................................................................................................................................

3-26 |

|

SUMMARY OF AVIATION FORECASTS ..........................................................................................

3-28 |

|

CHAPTER 4 – DEMAND CAPACITY AND FACILITY

REQUIREMENTS........................ 4-1 |

|

INTRODUCTION.............................................................................................................................

4-1 General.......................................................................................................................................................

4-1 Airport

Reference

Code..............................................................................................................................

4-2 |

|

AIRSPACE CAPACITY.....................................................................................................................

4-3 |

|

AIRFIELD

CAPACITY .....................................................................................................................

4-7 Airfield Operational

Capacity....................................................................................................................

4-7 Airfield

Characteristics ..............................................................................................................................

4-8 Operational

Characteristics......................................................................................................................

4-12 Hourly Capacity of

Runways.....................................................................................................................

4-15 Annual Service Volume

.............................................................................................................................

4-16 Aircraft Group Capacity

Demand.............................................................................................................

4-19 |

|

ANNUAL AIRCRAFT DELAY .........................................................................................................

4-23 |

|

SUMMARY OF AIRFIELD CAPACITY ANALYSIS .............................................................................

4-23 |

|

FACILITY REQUIREMENTS ...........................................................................................................

4-25 Airport Role and

Service

Level..................................................................................................................

4-26 |

|

AIRFIELD

FACILITIES REQUIREMENTS .........................................................................................

4-26 Runway Requirements

...............................................................................................................................

4-26 Taxiway

Requirements

..............................................................................................................................

4-30 Airfield Lighting

........................................................................................................................................

4-34 Airfield

Signage.........................................................................................................................................

4-35 Pavement Markings...................................................................................................................................

4-35 Weather Instruments

.................................................................................................................................

4-36 |

|

GENERAL AVIATION REQUIREMENTS ..........................................................................................

4-37 Hangar

Demand........................................................................................................................................

4-37 |

|

Aircraft

Parking Apron

.............................................................................................................................

4-44 |

|

AIRPORT ACCESS ........................................................................................................................

4-50 |

|

AIRPORT

SUPPORT FACILITIES.....................................................................................................

4-51 Electrical Vault

.........................................................................................................................................

4-51 Aircraft Fuel

Storage

................................................................................................................................

4-51 FBO Terminal

Building.............................................................................................................................

4-53 |

|

|

|

|

|

Automobile Parking

Requirements............................................................................................................

4-54 |

|

GA

PASSENGERS AND AUTOMOBILE REQUIREMENTS...................................................................

4-55 Security

Fencing........................................................................................................................................

4-58 |

|

SUMMARY OF FACILITY REQUIREMENTS.....................................................................................

4-59 |

|

CHAPTER 5 – AIRPORT ALTERNATIVES

ANALYSIS ...................................................... 5-1 |

|

GENERAL

.....................................................................................................................................

5-1 |

|

DEVELOPMENT CONSIDERATIONS................................................................................................

5-1 City of Jacksonville

Planning and

Development.............................................................................................

5-2 Previous Master

Plan......................................................................................................................................

5-3 |

|

PREFERRED CONCEPT SUMMARY.................................................................................................

5-4 |

|

DEVELOPMENT CONCEPTS ...........................................................................................................

5-5 Runway Length

Analysis

.................................................................................................................................

5-5 Airport Elevation

Adjustment..........................................................................................................................

5-7 Temperature Adjustment

.................................................................................................................................

5-8 Pavement Conditions

......................................................................................................................................

5-8 Instrument Approach Analysis .......................................................................................................................

5-10 Air Traffic Control

.........................................................................................................................................

5-10 GA Security Requirements

.............................................................................................................................

5-10 |

|

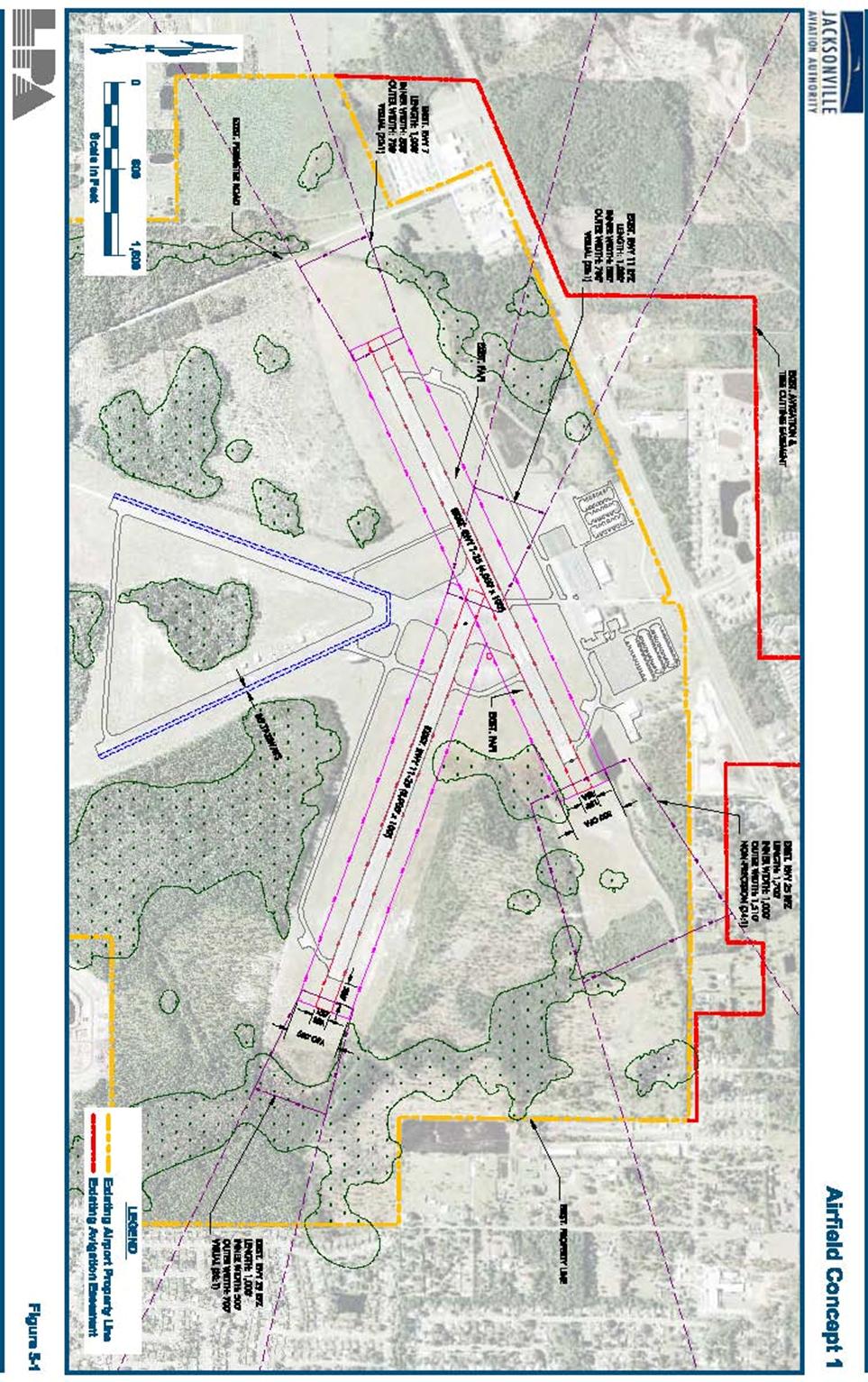

AIRFIELD CONCEPTS ..................................................................................................................

5-11 Airfield Concept 1

(No Build/Limited Development)

.....................................................................................

5-12 Airfield

Concept 2 (Constrained Development).............................................................................................

5-15 Airfield Concept 3 (Unconstrained

Development).........................................................................................

5-21 Environmental Assessment.............................................................................................................................

5-30 Evaluation of Concepts

..................................................................................................................................

5-30 Recommended Airfield

Concept.....................................................................................................................

5-31 Land Use

........................................................................................................................................................

5-39 Airport

Operations.........................................................................................................................................

5-41 Corporate and Light General Aviation

..........................................................................................................

5-41 Airport Commerce and Industrial Park

.........................................................................................................

5-42 Residential

Development................................................................................................................................

5-43 Mixed Use

......................................................................................................................................................

5-44 Low Density Uses for Approach/Transition Zones

........................................................................................

5-46 |

|

LANDSIDE FACILITIES

– BUILDING AREAS.................................................................................

5-46 GA and Related

Aeronautical Development Areas

........................................................................................

5-49 North Landside

Development.........................................................................................................................

5-51 North Landside Concept 1

.............................................................................................................................

5-51 North Landside Concept

2..............................................................................................................................

5-54 North Landside Concept 3

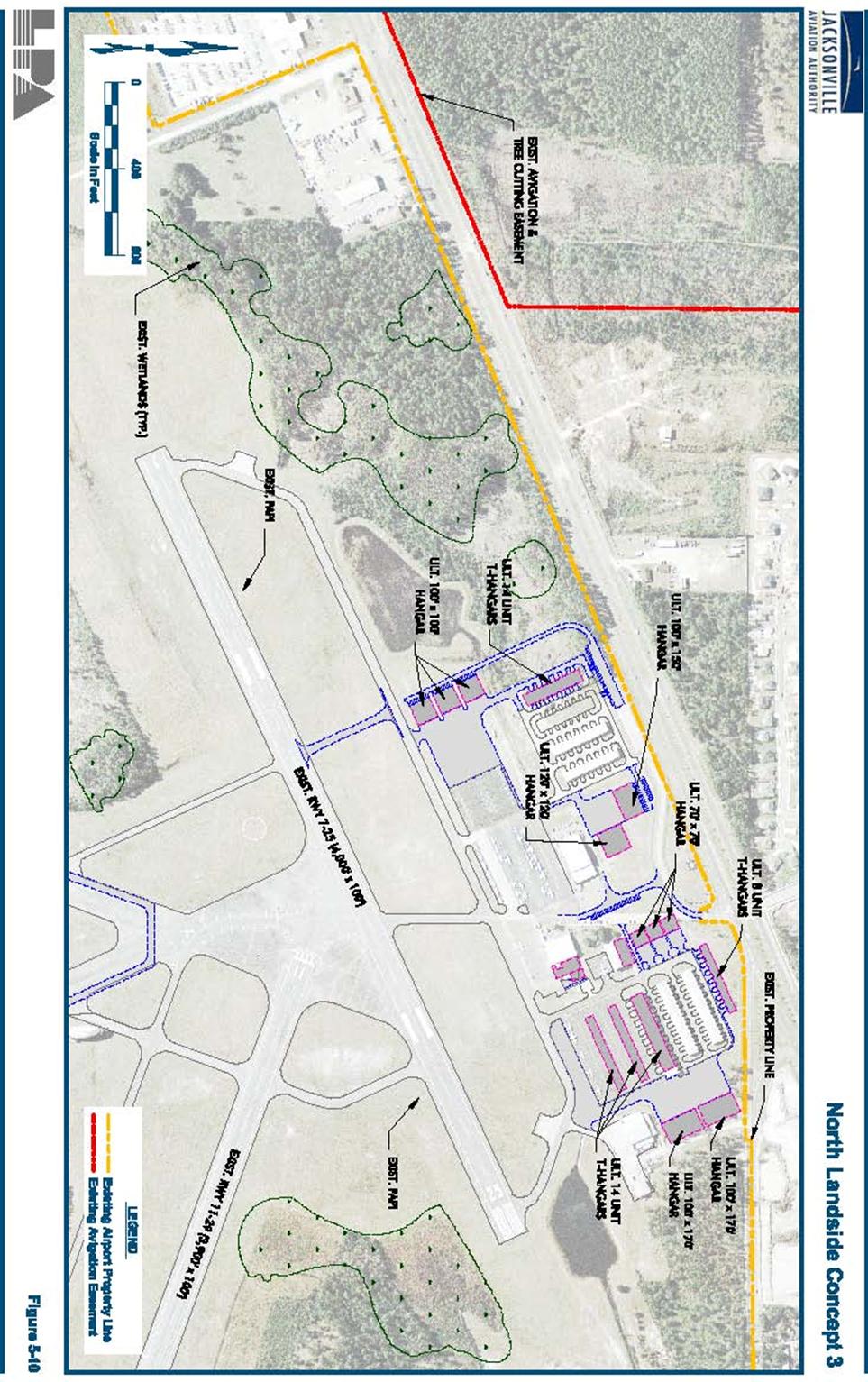

.............................................................................................................................

5-57 Evaluation Criteria

........................................................................................................................................

5-60 Recommended North Landside

Development.................................................................................................

5-61 Potential Environmental

Impacts...................................................................................................................

5-61 Regulatory Requirements...............................................................................................................................

5-62 State

Permit....................................................................................................................................................

5-62 City of Jacksonville Concurrency Compliance

..............................................................................................

5-62 |

|

|

|

|

|

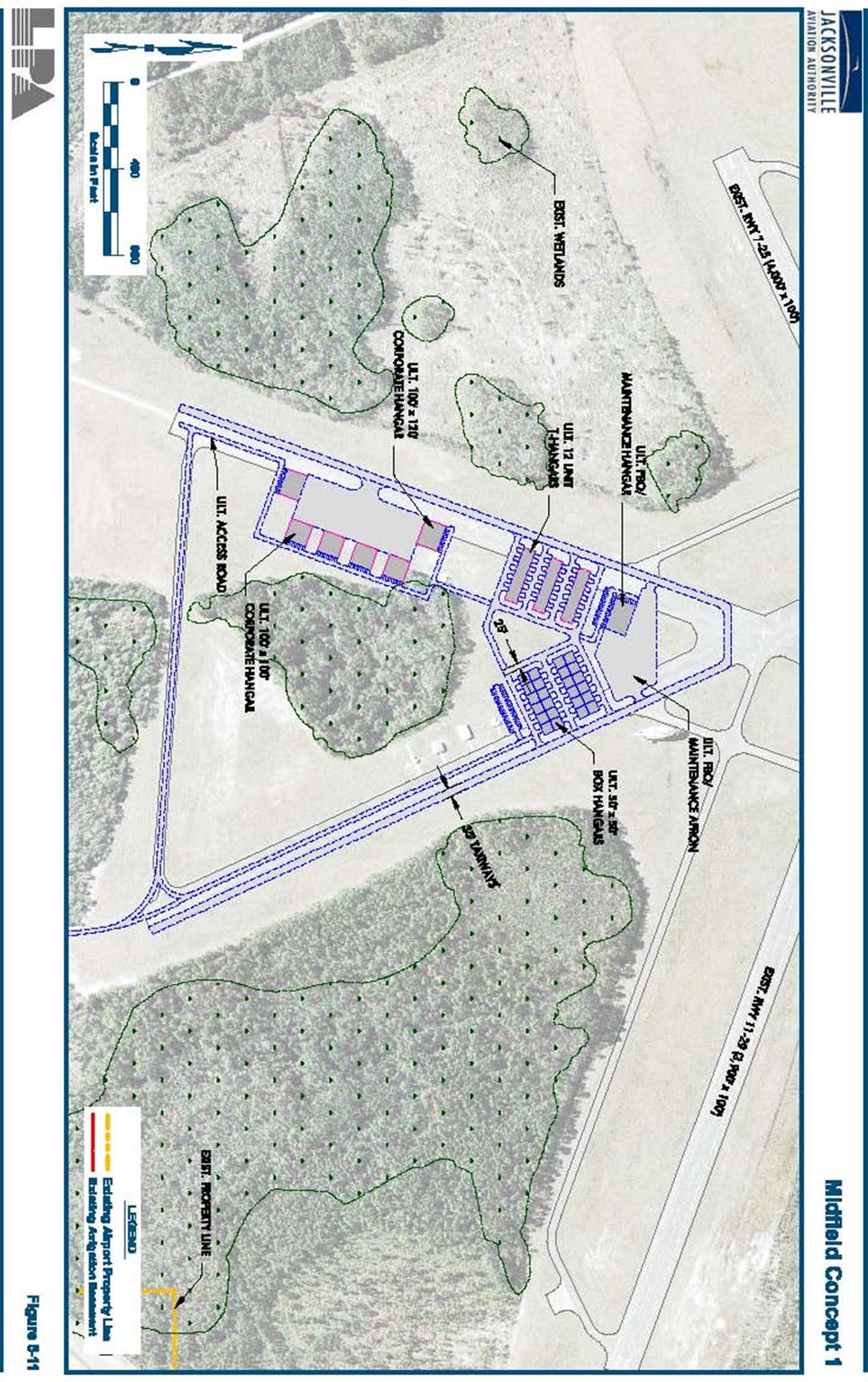

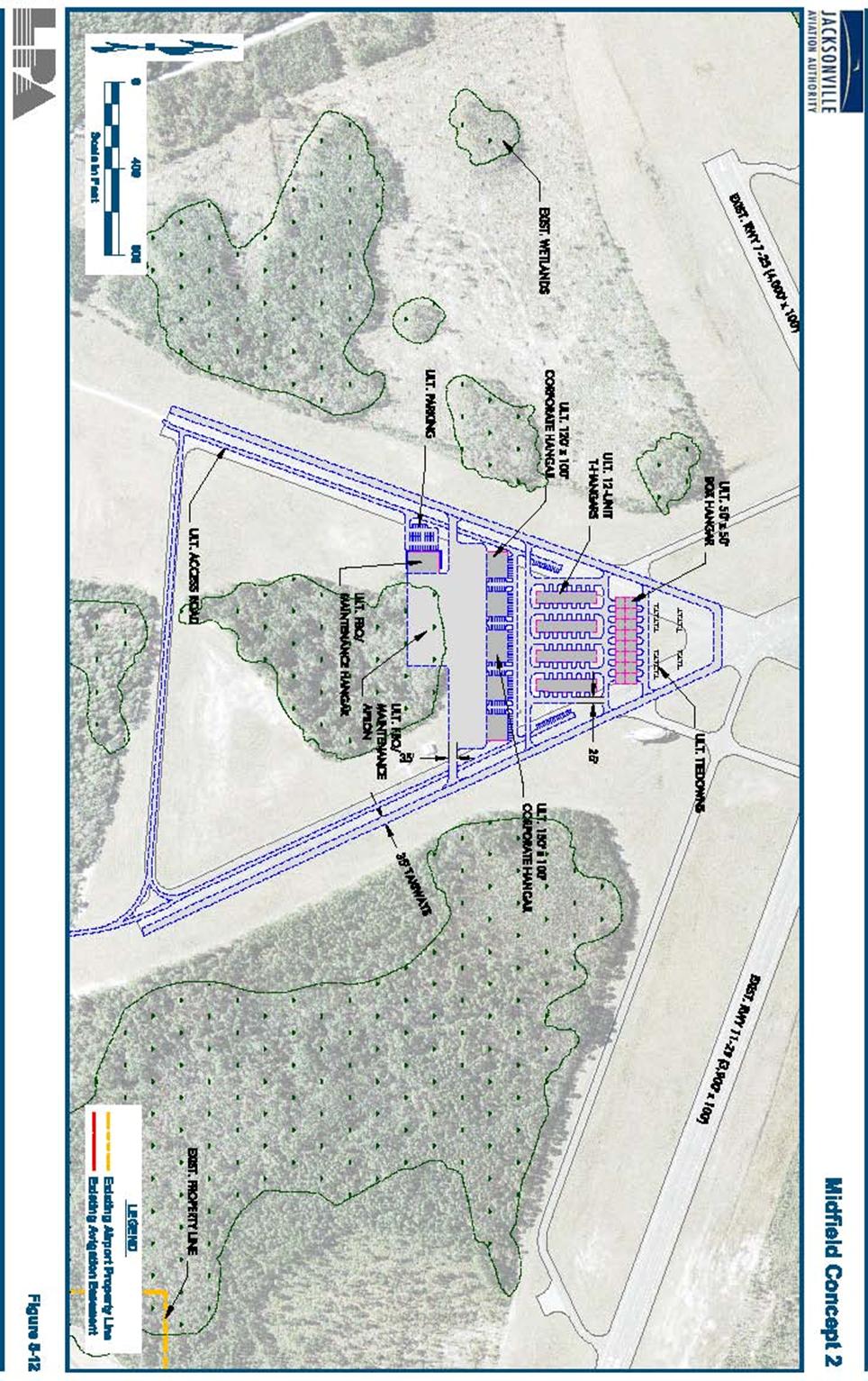

Midfield Concept Development .....................................................................................................................

5-63 Midfield Concept

1........................................................................................................................................

5-64 Midfield Concept 2

.......................................................................................................................................

5-67 Evaluation Criteria

........................................................................................................................................

5-72 Recommended Midfield

Development............................................................................................................

5-72 Potential Environmental Impact

....................................................................................................................

5-73 Regulatory

Requirements................................................................................................................................

5-73 State

Permit....................................................................................................................................................

5-73 City of Jacksonville Concurrency Issues........................................................................................................

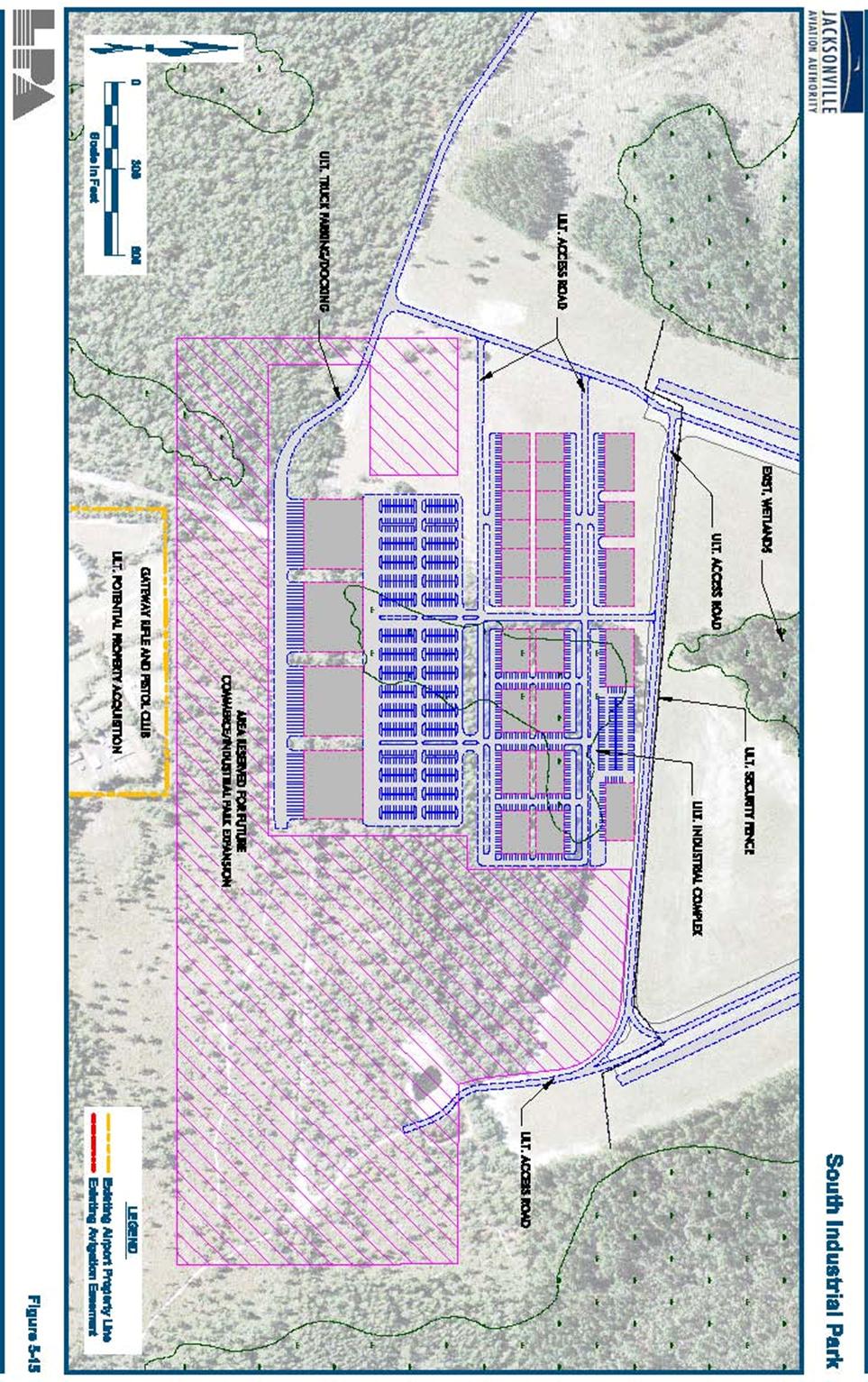

5-73 Industrial/Commerce Park

Development.......................................................................................................

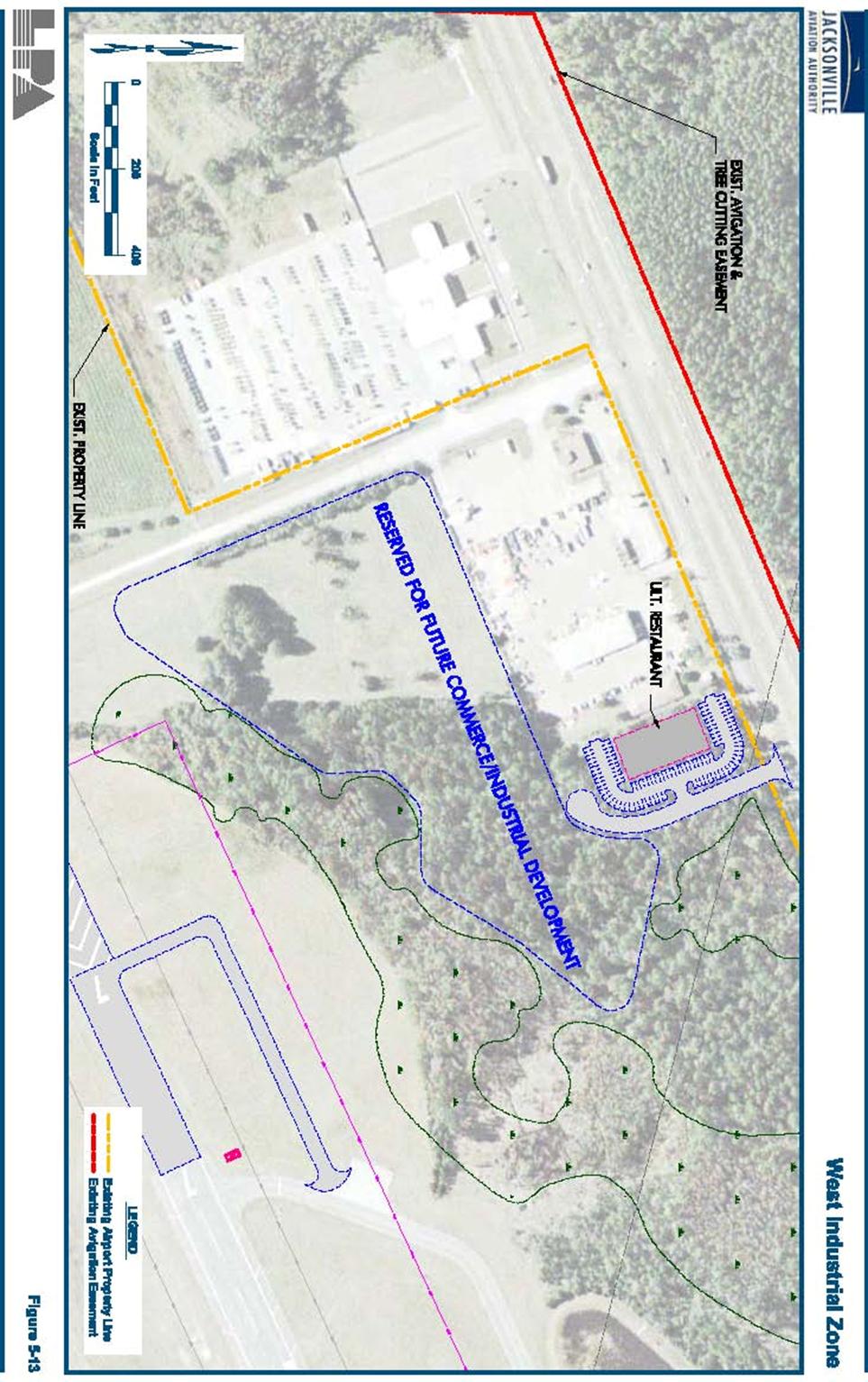

5-74 West Industrial Development..........................................................................................................................

5-74 East Commerce Park

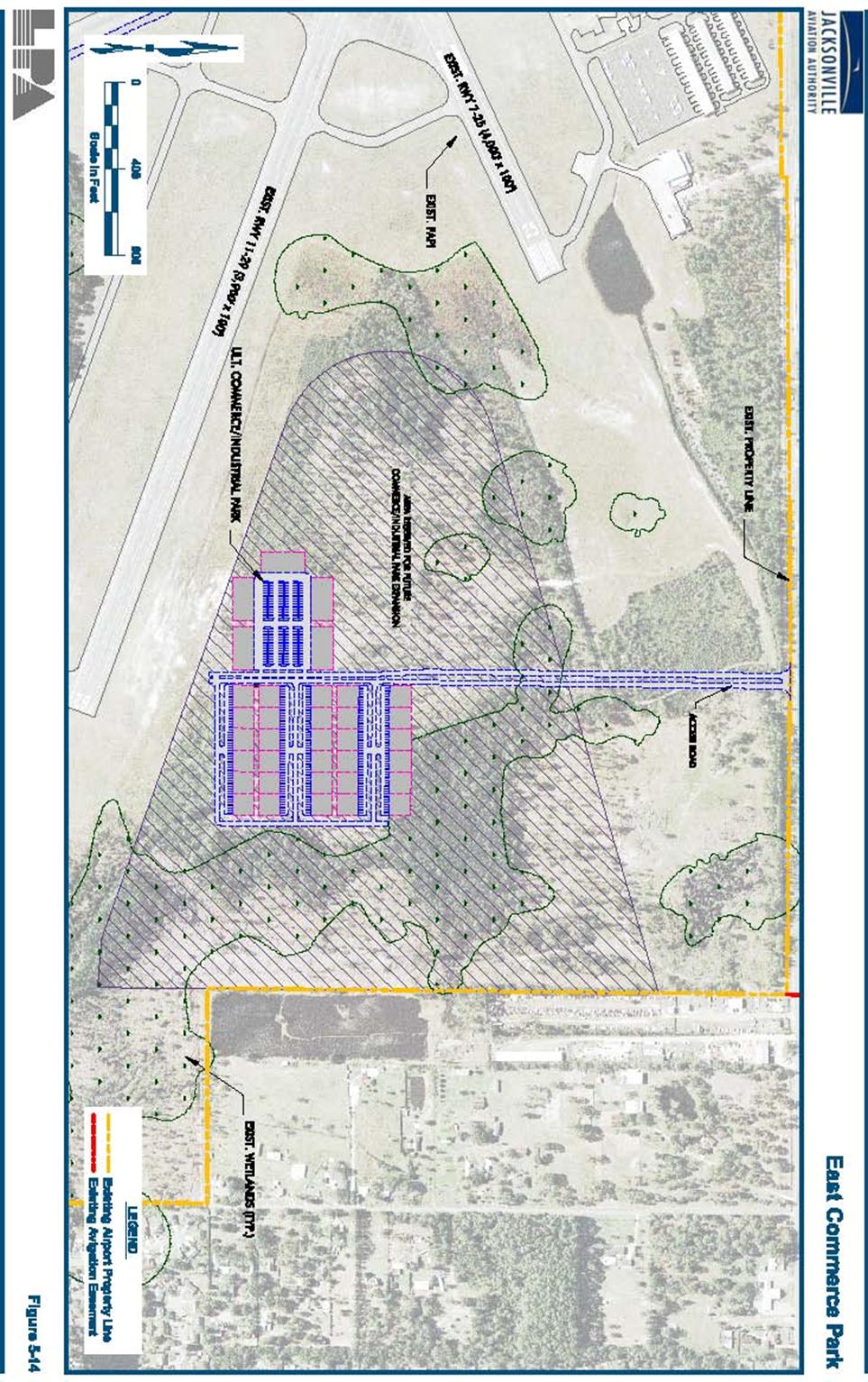

Development................................................................................................................

5-77 South Commerce/Industrial

Development......................................................................................................

5-79 Potential environmental Impacts

...................................................................................................................

5-83 Regulatory

Requirements................................................................................................................................

5-83 State and Federal Permits..............................................................................................................................

5-84 City of Jacksonville Concurrency

..................................................................................................................

5-84 |

|

SUPPORT FACILITIES..................................................................................................................

5-85 Roadways, Ground

Access and Signage ........................................................................................................

5-85 Airport

Maintenance

Hangar.........................................................................................................................

5-85 Security and Fencing ......................................................................................................................................

5-85 Fuel Storage

...................................................................................................................................................

5-85 Electrical Vault

..............................................................................................................................................

5-85 Air Traffic Control Tower ..............................................................................................................................

5-86 |

|

CONCLUSIONS............................................................................................................................

5-86 |

|

CHAPTER

6 – AIRPORT LAYOUT PLAN

.............................................................................

6-1 COVER SHEET ..............................................................................................................................

6-2 AIRPORT LAYOUT DRAWING ........................................................................................................6-2

GENERAL AVIATION TERMINAL AREA DRAWING ........................................................................

6-3 INNER APPROACH ZONE PROFILES...............................................................................................

6-3 AIRPORT AIRSPACE DRAWING .....................................................................................................

6-3 AIRPORT LAND USE DRAWING ....................................................................................................

6-4 AIRPORT PROPERTY MAP.............................................................................................................

6-5 SUMMARY....................................................................................................................................

6-5 |

|

CHAPTER 7 – IMPLEMENTATION AND CAPITAL

IMPROVEMENT PLAN .................. 7-1 GENERAL ....................................................................................................................................

7-1 FUNDING SOURCES ......................................................................................................................

7-2 Federal Funding

............................................................................................................................................. 7-2 State

Funding..................................................................................................................................................

7-3 Local (Sponsor) Funding

................................................................................................................................

7-8 Other Funding Sources

...................................................................................................................................

7-9 |

|

|

|

|

|

Third Party/Private Development .................................................................................................................. 7-10 FINANCIAL

FEASIBILITY.............................................................................................................

7-10 |

|

Capital Improvement Plan

............................................................................................................................. 7-10 |

|

Program Phasing and Cost Estimates

...........................................................................................................

7-10 |

|

Short-Term

Developments..............................................................................................................................

7-11 |

|

Intermediate-Term

Developments..................................................................................................................

7-12 |

|

Long-Term Developments

..............................................................................................................................

7-12 |

|

CIP Summary

................................................................................................................................................. 7-26 CASH FLOW ANALYSIS ..............................................................................................................

7-32 |

|

Projected Operating Revenues and

Expenses

................................................................................................ 7-33 |

|

Cash Flow Assessment

...................................................................................................................................

7-37 CONCLUSIONS............................................................................................................................

7-43 |

|

APPENDICES

APPENDIX A – GLOSSARY OF TERMS

..............................................................................

A-1 APPENDIX B -FAA/FDOT AND RELATED DATA ............................................................

B-1 APPENDIX C – REGIONAL GUIDANCE

LETTER............................................................... C-1

APPENDIX D – AIRCRAFT NOISE

ANALYSIS...................................................................

D-1 APPENDIX E – PRELIMINARY ESTIMATES OF PROJECT COSTS

................................. E-1 APPENDIX F -PUBLIC INVOLVEMENT AND

RUNWAY EXTENSION LETTERS........F-1 APPENDIX G -FAA PROJECT PRIORITY FUNDING

........................................................ G-1 APPENDIX H -

FLORIDA PUBLIC

LAW...............................................................................H-1

APPENDIX I - HERLONG AIRPORT TITLE SEARCH

INFORMATION..............................I-1 |

|

|

|

|

|

|

|

|

|

TABLE 3-12

FORECAST ANNUAL GENERAL AVIATION AIRCRAFT OPERATIONS...................3-22

TABLE 3-13 HISTORIC AND FORECAST MILITARY OPERATIONS

................................................3-24 TABLE 3-14 LOCAL VS.

ITINERANT OPERATIONS

.............................................................................3-25

TABLE 3-15 PROJECTED ANNUAL INSTRUMENT OPERATIONS

....................................................3-26 TABLE 3-16 FORECAST

PEAK GENERAL AVIATION ACTIVITY

ONLY.........................................3-27 TABLE 3-17 COMPARISON OF

TAF AND AIRPORT OPERATIONS FORECAST............................3-28 TABLE

3-18 AIRPORT PLANNING FORECASTS FORECAST LEVELS AND GROWTH RATES .3-29 TABLE

4-1 AIRCRAFT APPROACH CATEGORIES

.............................................................................

4-3 TABLE 4-2 AIRCRAFT DESIGN

GROUPS...............................................................................................

4-3 TABLE 4-3 EXIT TAXIWAY LOCATIONS

.............................................................................................

4-11 TABLE 4-4 FAA AIRCRAFT

CLASSIFICATIONS.................................................................................

4-12 TABLE 4-5 RUNWAY END

UTILIZATION.............................................................................................

4-14 TABLE 4-6 CALCULATION OF HOURLY

CAPACITY........................................................................

4-15 TABLE 4-7 HOURLY CAPACITY OF RUNWAY COMPONENT CALCULATION MATRIX........

4-17 TABLE 4-8 ANNUAL AIRFIELD CAPACITY

.........................................................................................

4-18 TABLE 4-9 GA DAILY OPPORTUNITY COSTS ....................................................................................

4-21 TABLE 4-10 SUMMARY OF AIRFIELD CAPACITY ANALYSIS

......................................................... 4-24 TABLE 4-11

WIND COVERAGE PERCENTAGES ..................................................................................

4-28 TABLE 4-12 BASED AIRCRAFT DEMAND

..............................................................................................

4-38 TABLE 4-13 FORECAST PERCENT OF BASED AIRCRAFT DEMAND

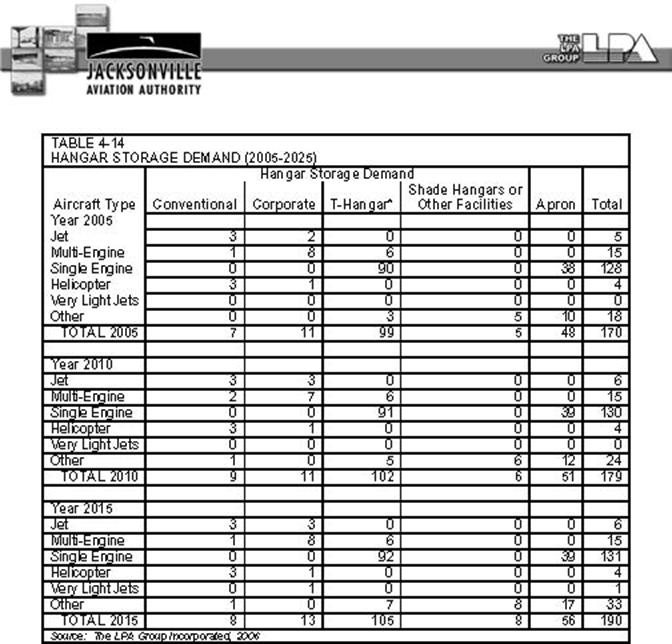

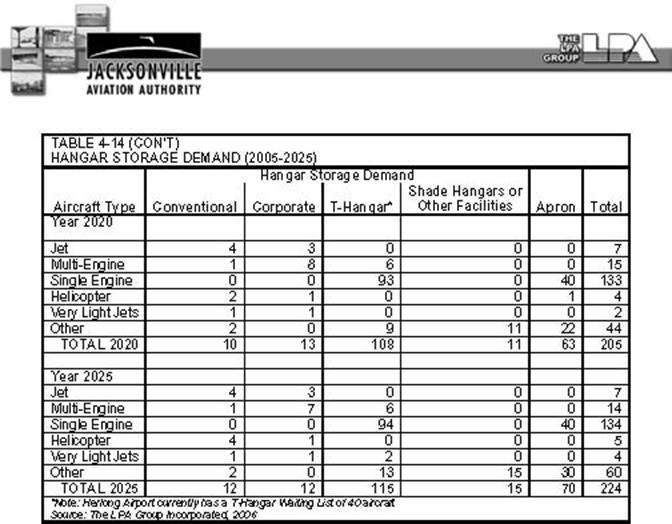

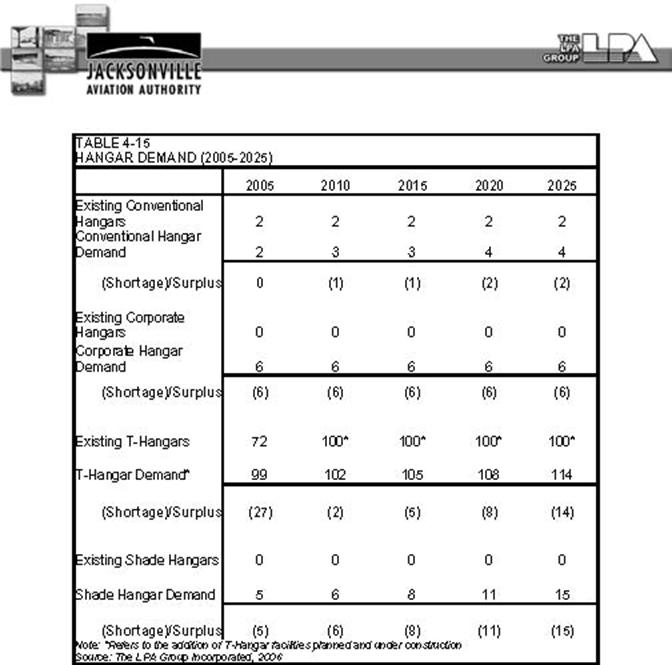

............................................. 4-39 TABLE 4-14 HANGAR STORAGE

DEMAND

(2005-2025).......................................................................

4-40 TABLE 4-15 HANGAR DEMAND

(2005-2025) ............................................................................................4-42

TABLE 4-16 CONVENTIONAL AND CORPORATE HANGAR APRON REQUIREMENTS (BASED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIGURE 1-1 STEPS IN THE MASTER PLANNING

PROCESS................................................ 1-14 FIGURE 2-1

AIRPORT LOCATION MAP

.....................................................................................

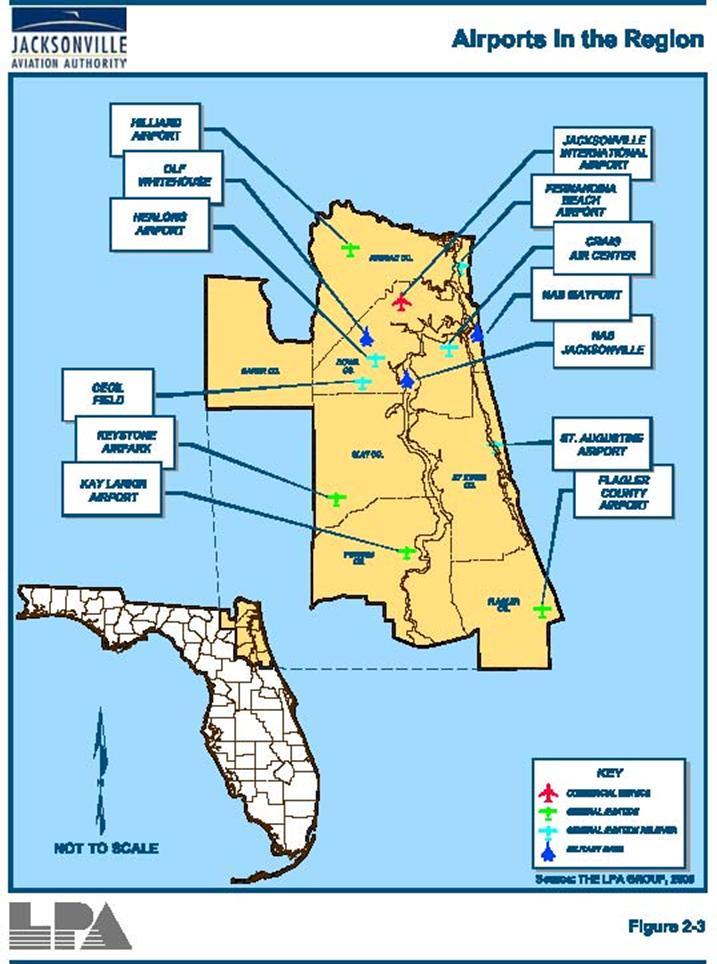

2-3 FIGURE 2-2 JACKSONVILLE AIRPORT SYSTEM

.................................................................... 2-4

FIGURE 2-3 AIRPORTS IN THE

REGION....................................................................................

2-6 FIGURE 2-4 ALL WEATHER WIND ROSE

..................................................................................

2-9 FIGURE 2-5 IFR WIND ROSE

........................................................................................................2-10

FIGURE 2-6 NPIAS AIRPORTS NORTHEAST FLORIDA

....................................................... 2-15 FIGURE 2-7

AIRSPACE CLASSES

...............................................................................................

2-16 FIGURE 2-8 AIRSPACE OBSTRUCTIONS .................................................................................

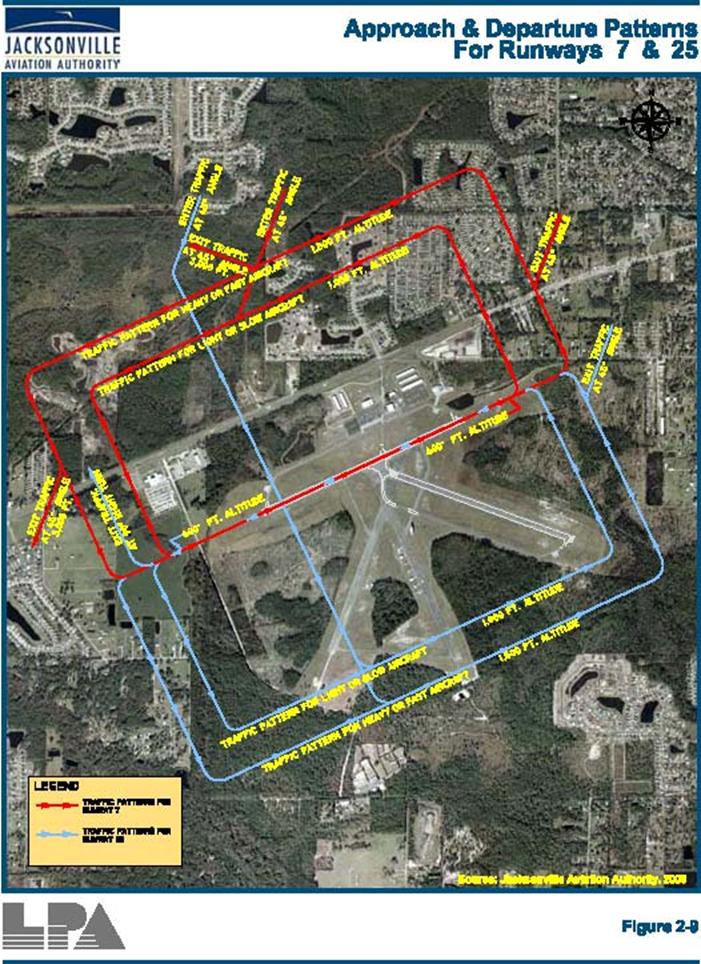

2-17 FIGURE 2-9 APPROACH AND DEPARTURE PATTERNS FOR RUNWAYS 7 &

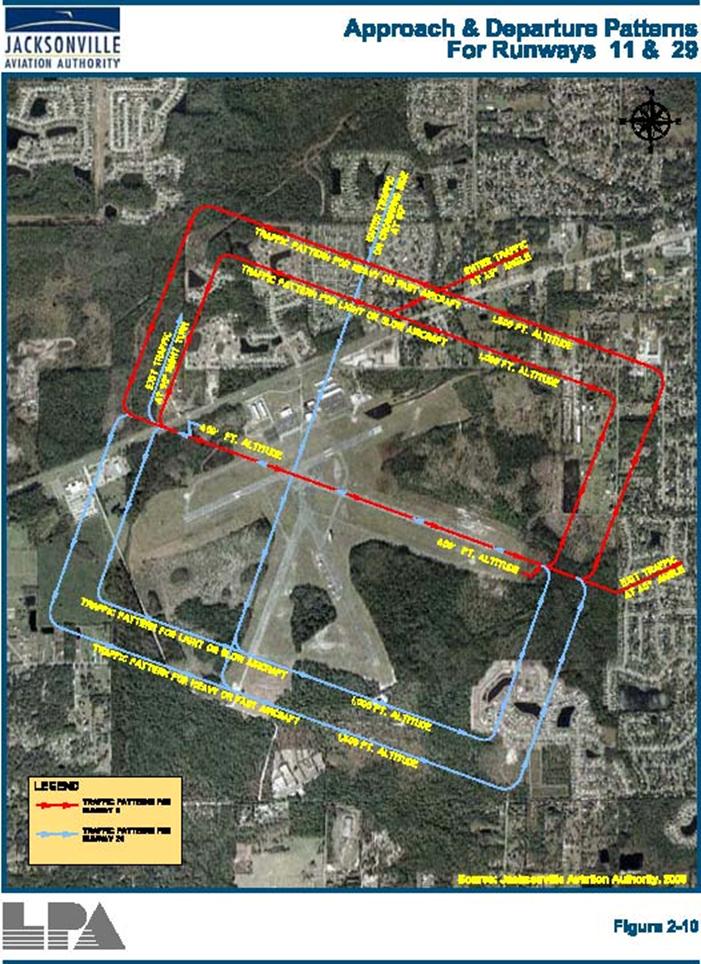

25............2-19 FIGURE 2-10 APPROACH AND DEPARTURE PATTERNS FOR RUNWAYS 11

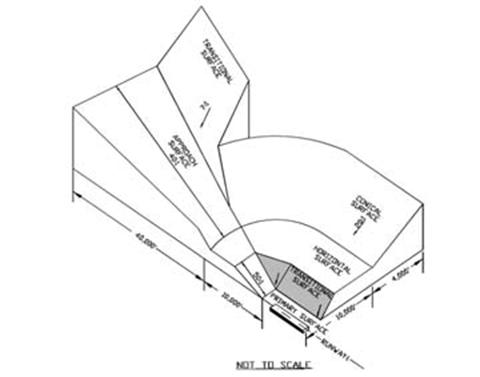

& 29..........2-20 FIGURE 2-11 TYPICAL PART 77

SURFACES..............................................................................

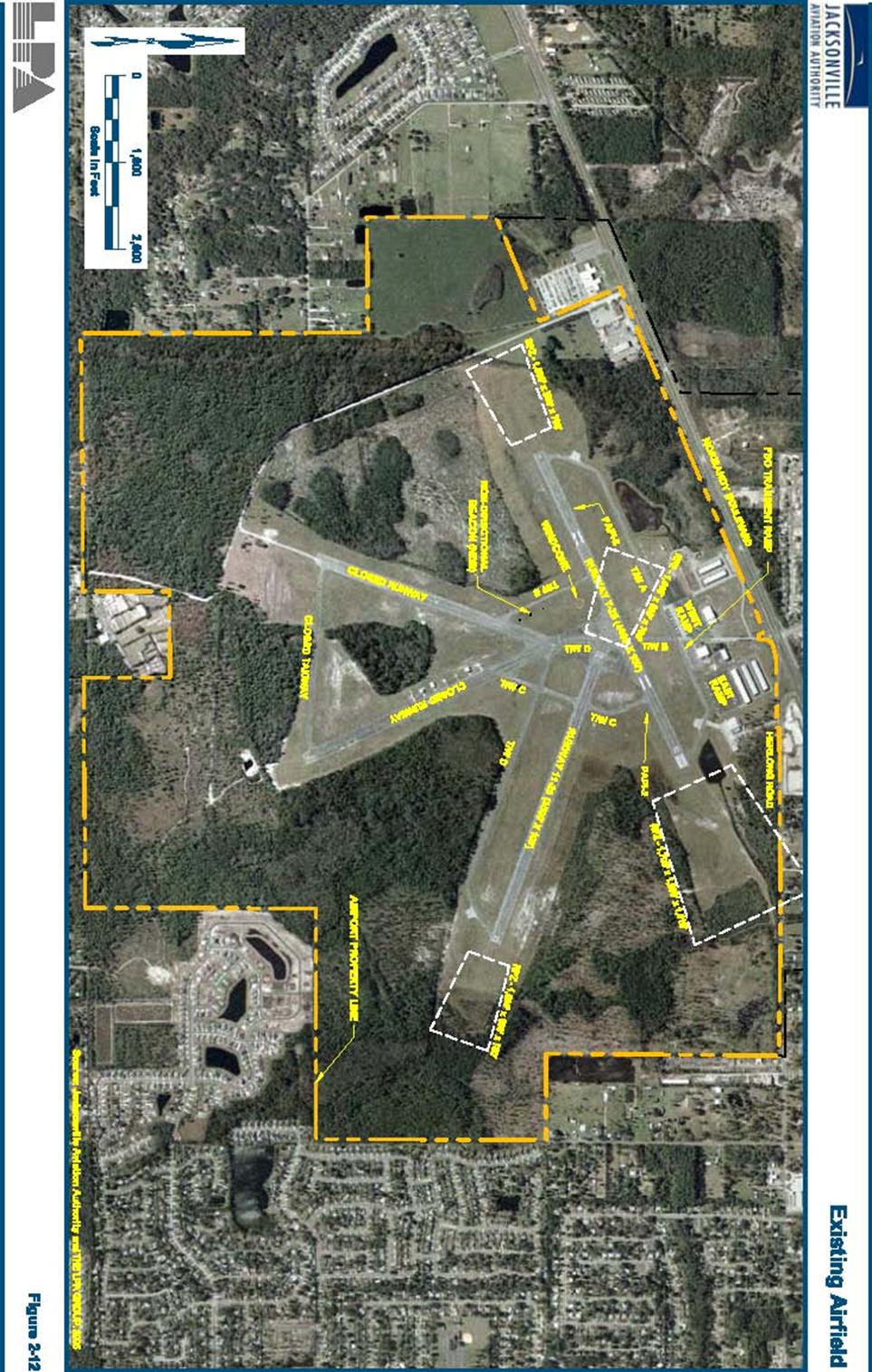

2-22 FIGURE 2-12 EXISTING AIRFIELD

..............................................................................................

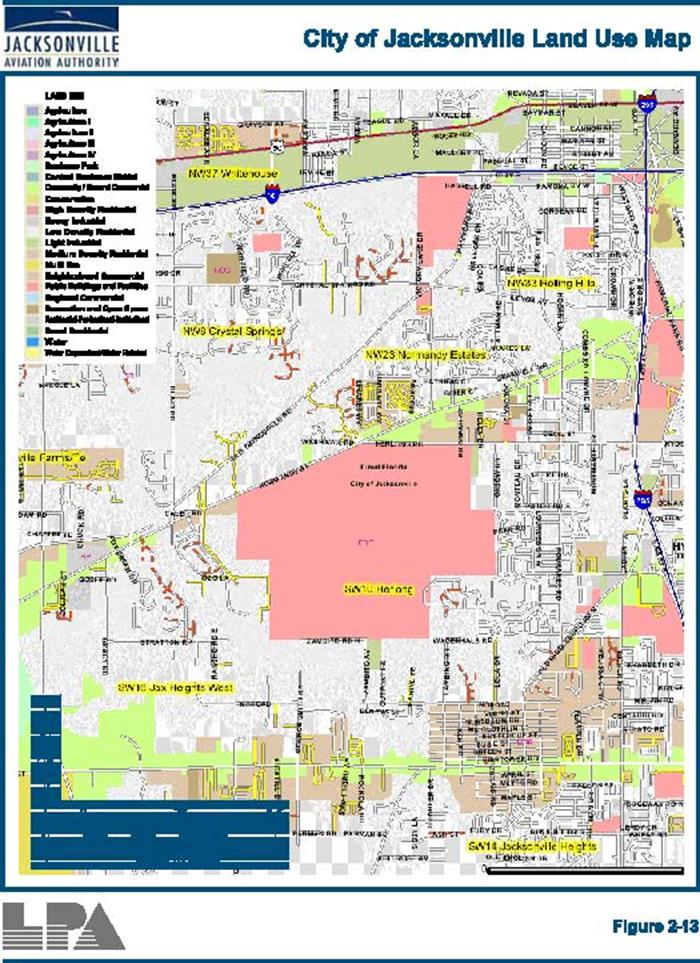

2-24 FIGURE 2-13 CITY OF JACKSONVILLE LAND USE MAP

...................................................... 2-31 FIGURE 2-14 CITY

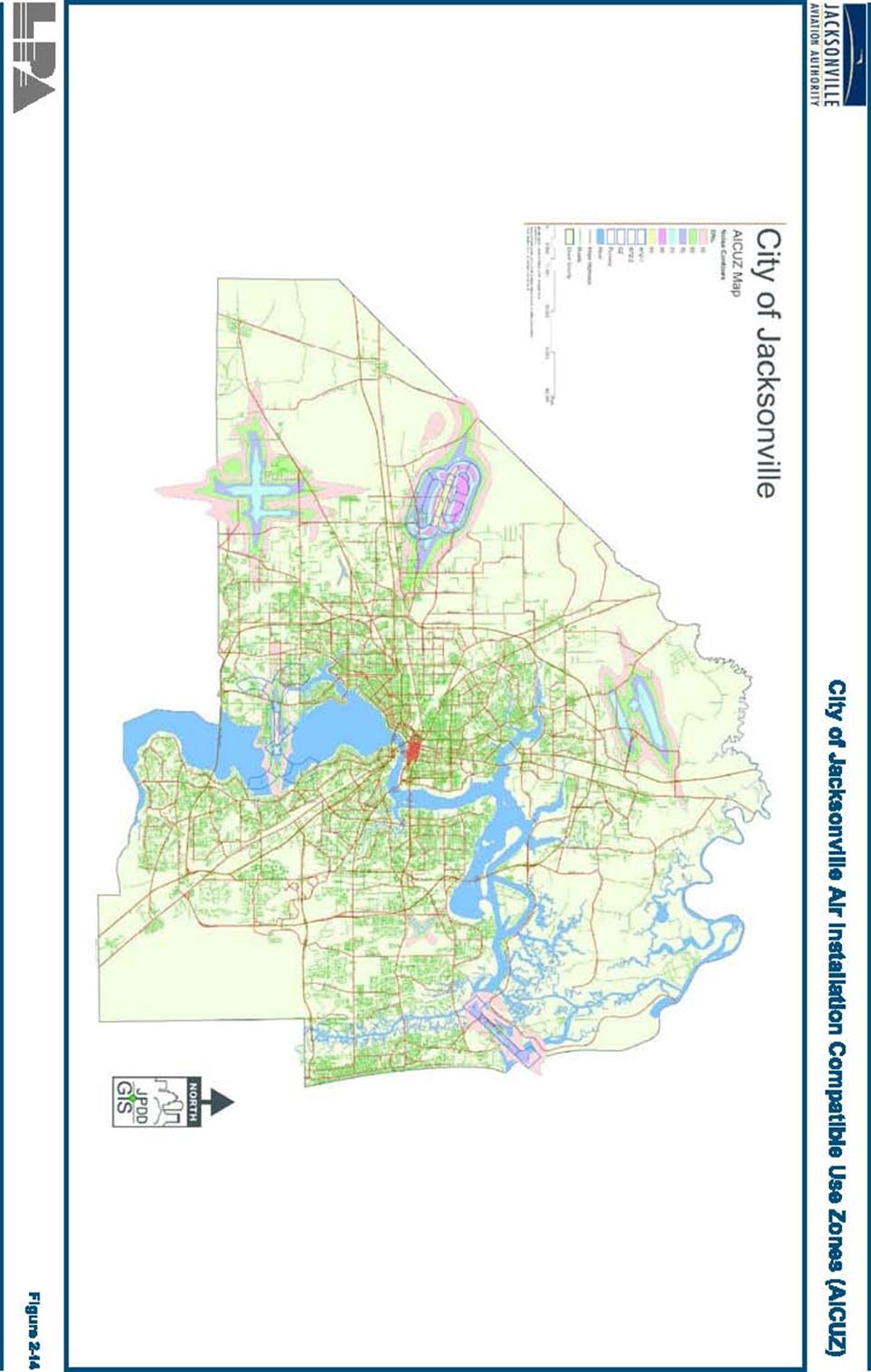

OF JACKSONVILLE AIR INSTALLATION COMPATIBLE USE ZONES |

|

(AICUZ).......................................................................................................................

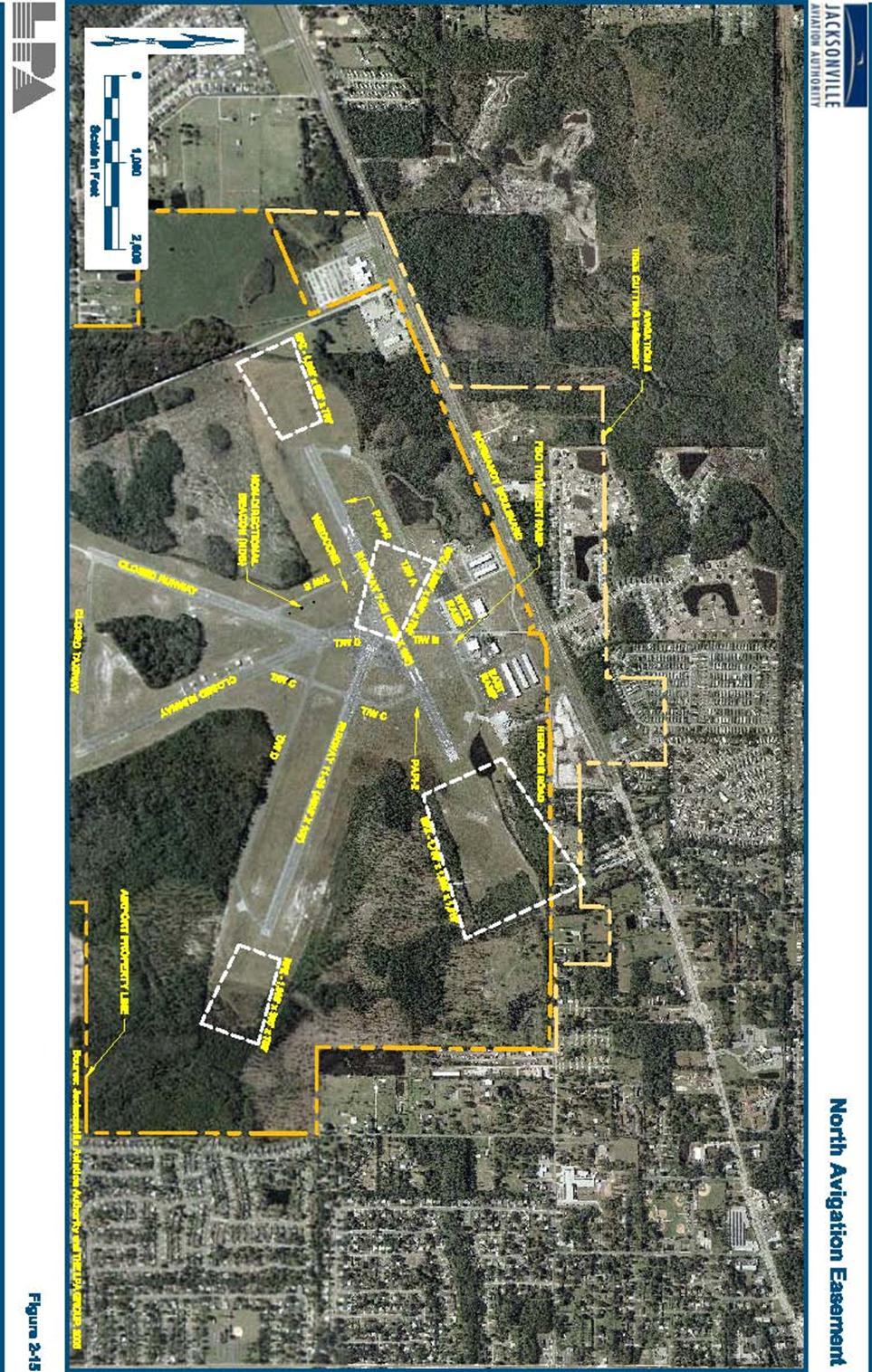

2-32 FIGURE 2-15 NORTH AVIGATION

EASEMENT........................................................................

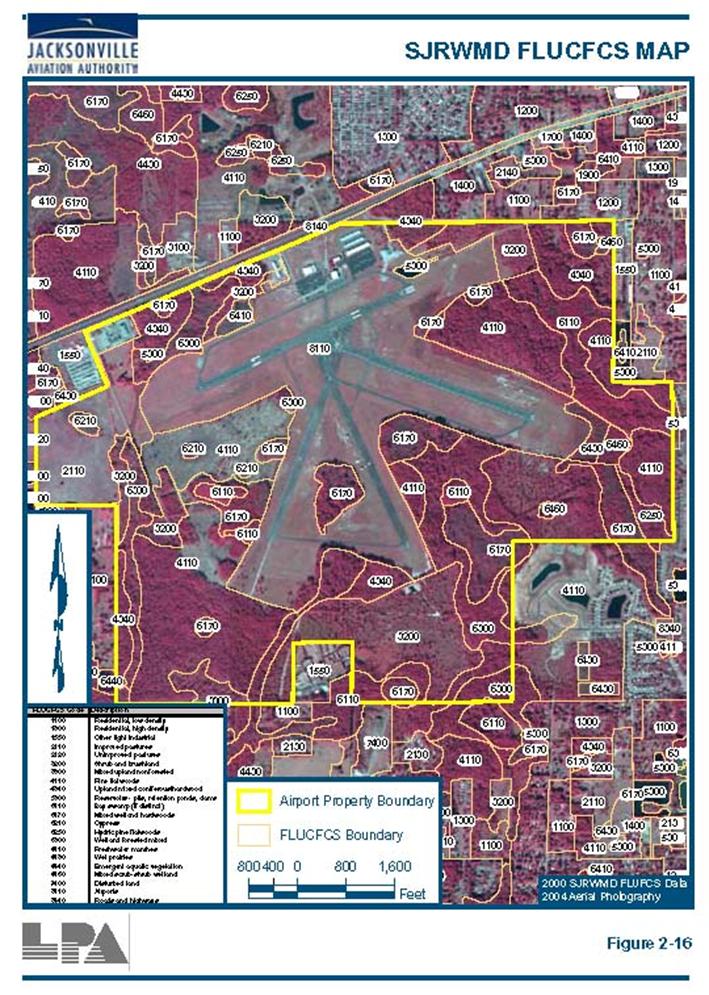

2-33 FIGURE 2-16 SJRWMD FLUCFCS MAP

.......................................................................................

2-42 |

|

|

|

|

|

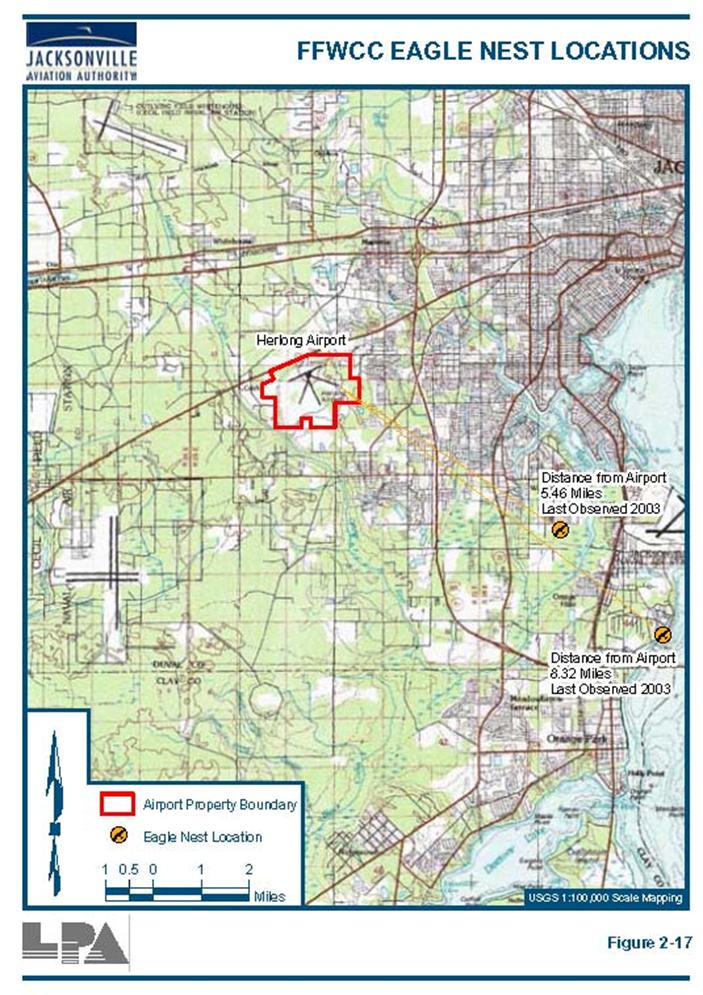

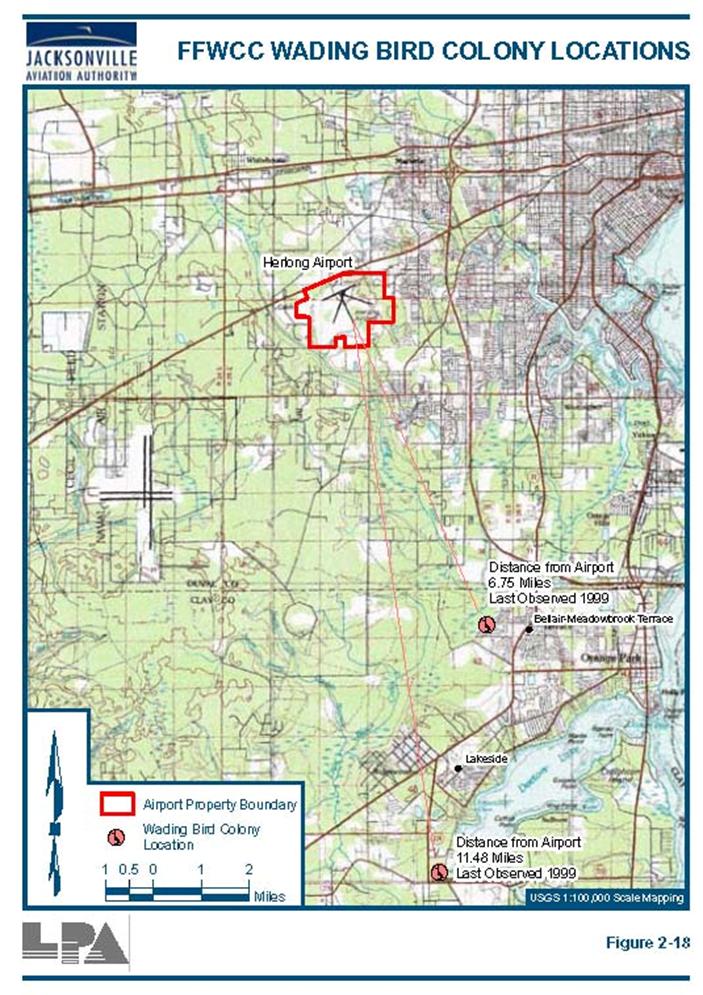

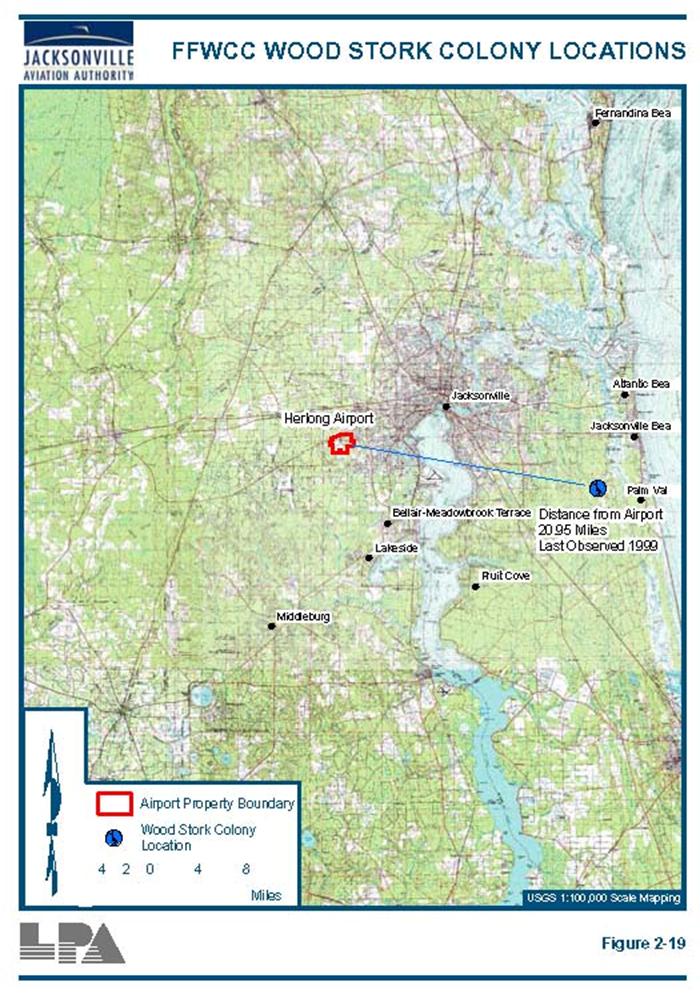

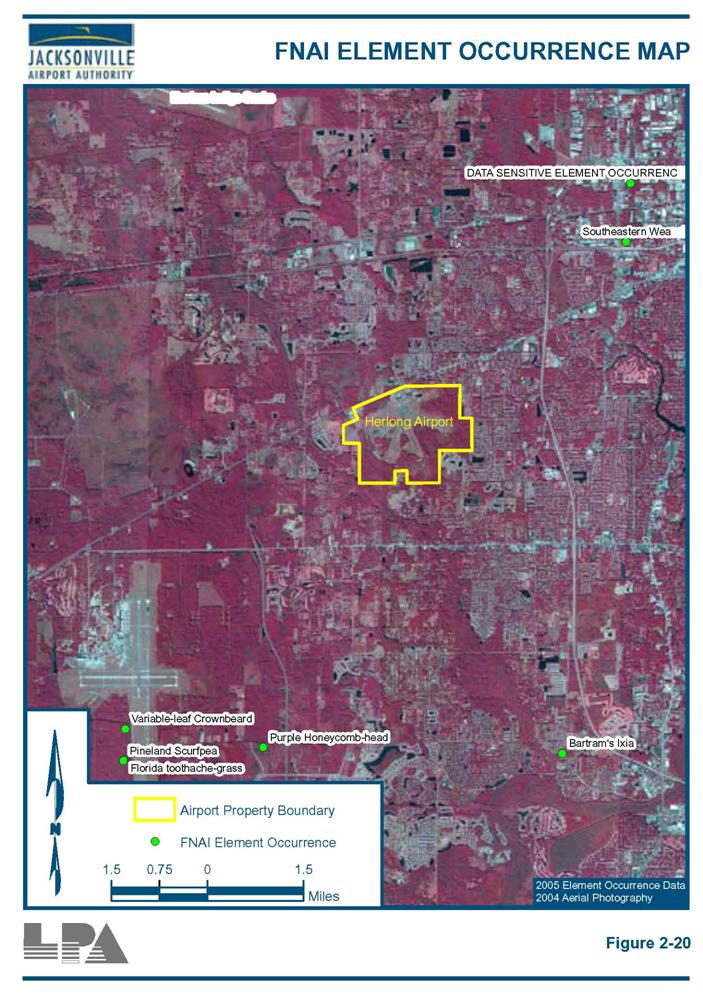

FIGURE

2-17 FFWCC EAGLE NEST LOCATIONS

.................................................................... 2-45 FIGURE

2-18 FFWCC WADING BIRD COLONY LOCATIONS

............................................... 2-46 FIGURE 2-19 FFWCC WOOD

STORK COLONY LOCATIONS ............................................... 2-47

FIGURE 2-20 FNAI ELEMENT OCCURRENCE MAP ................................................................

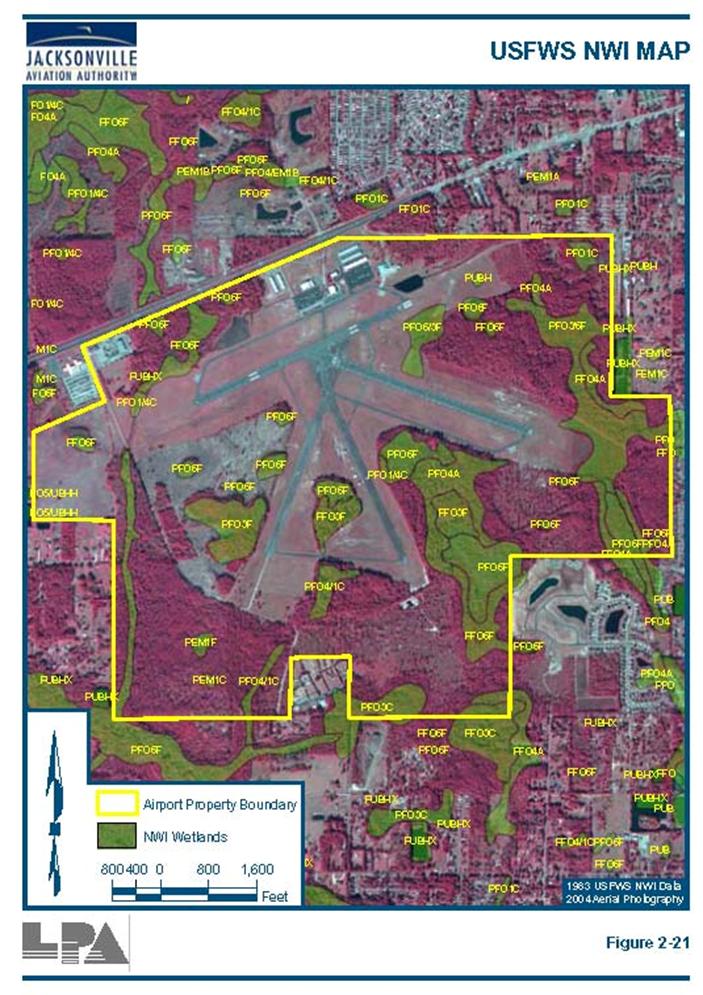

2-48 FIGURE 2-21 USFWS NWI MAP

.....................................................................................................

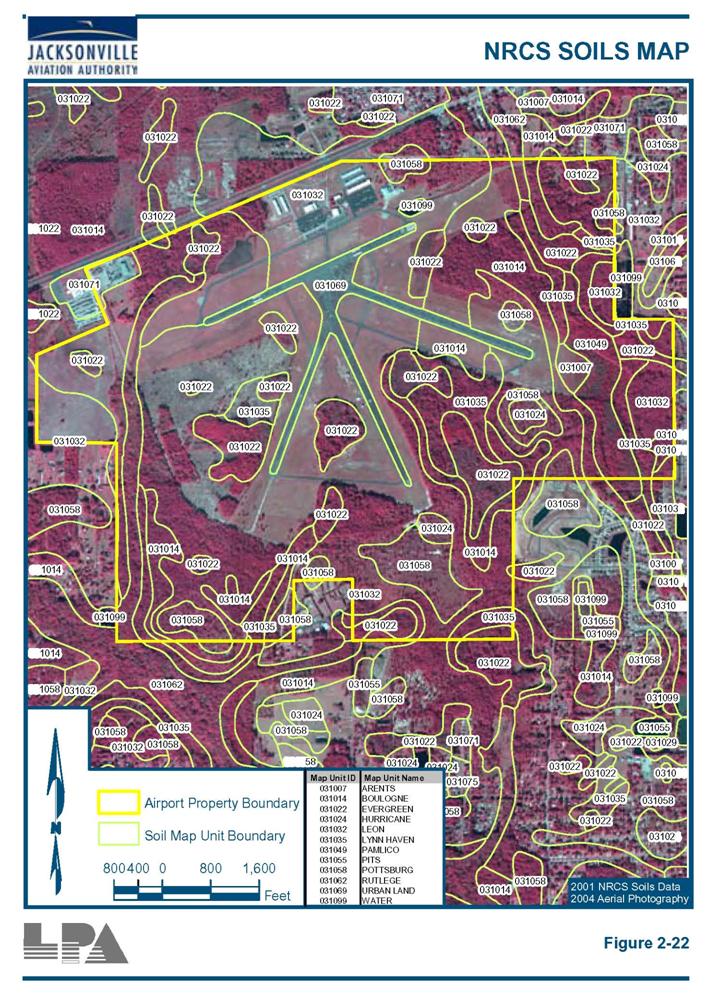

2-52 FIGURE 2-22 NRCS SOILS MAP.....................................................................................................

2-53 FIGURE 2-23 FEMA FLOODPLAINS

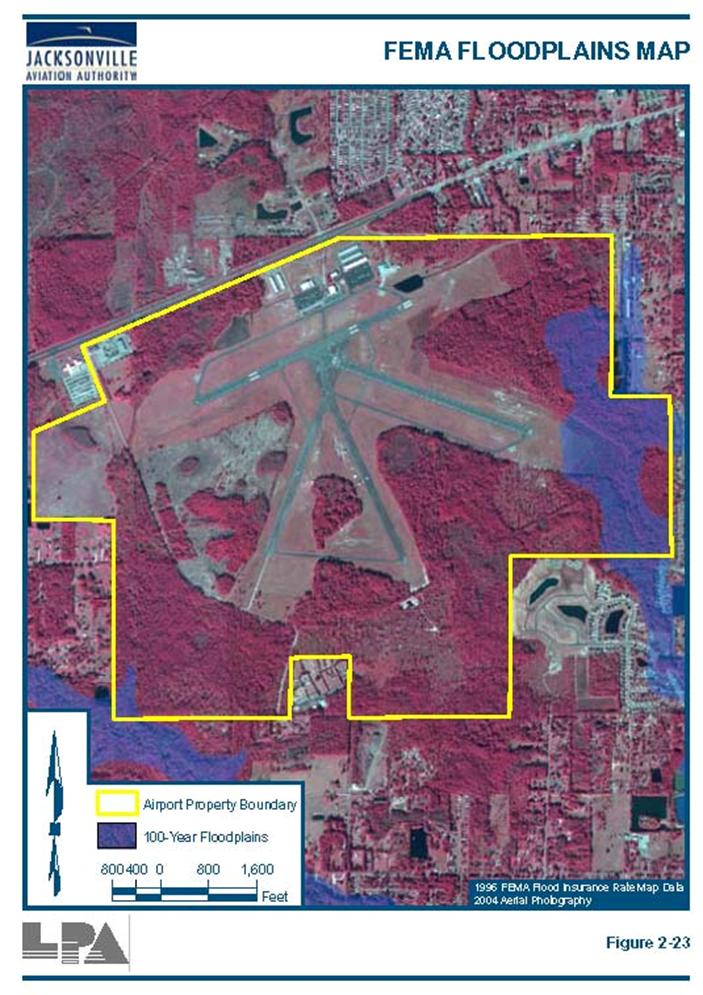

MAP...................................................................................

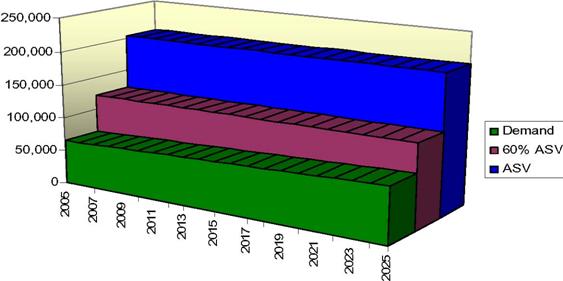

2-55 FIGURE 3-1 BASED AIRCRAFT FORECASTS ..........................................................................

3-16 FIGURE 3-2 BASED AIRCRAFT FLEET MIX

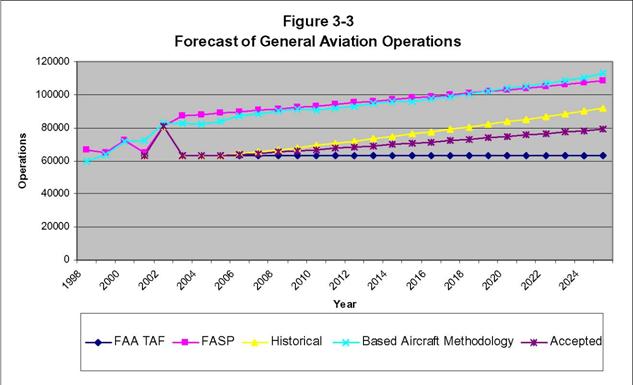

FORECASTS................................................... 3-20 FIGURE 3-3

FORECAST OF GENERAL AVIATION OPERATIONS.....................................

3-23 FIGURE 4-1 JACKSONVILLE SECTIONAL

................................................................................

4-5 FIGURE 4-2 U. S. AIRSPACE CLASSES

........................................................................................

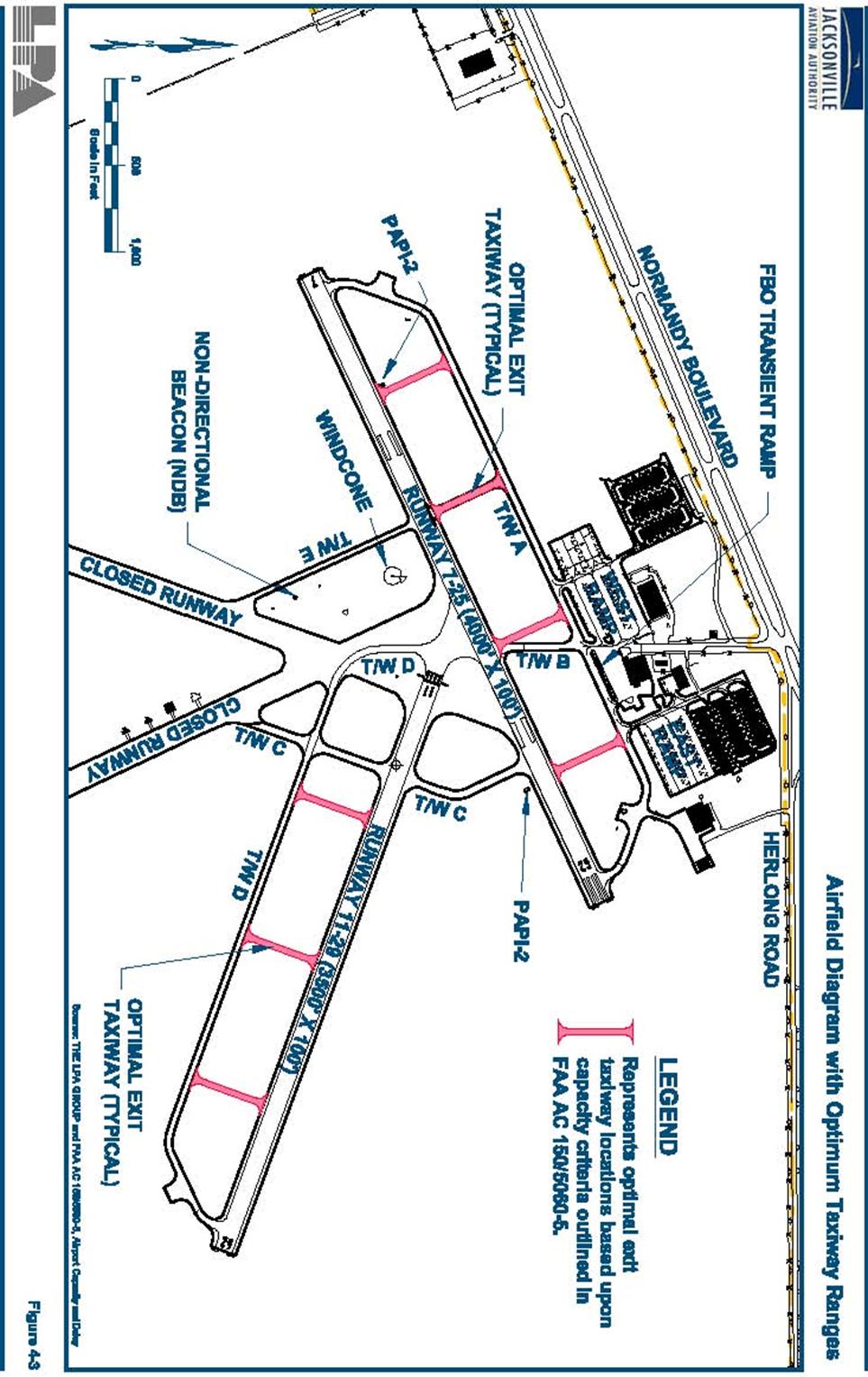

4-6 FIGURE 4-3 AIRFIELD DIAGRAM WITH OPTIMUM TAXIWAY RANGES

...................... 4-10 FIGURE 4-4 CAPACITY LEVEL COMPARISON

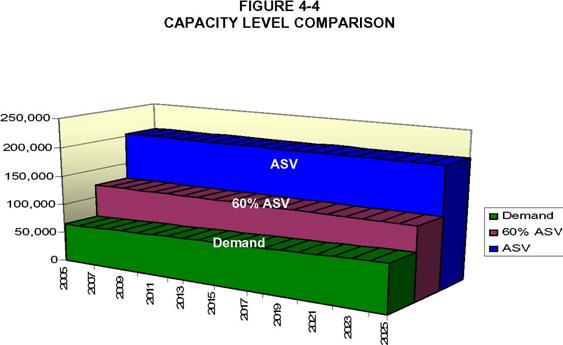

...................................................................... 4-19

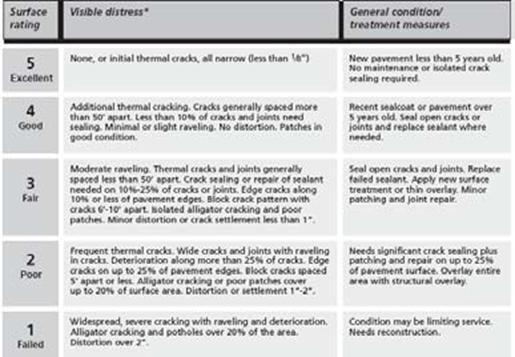

FIGURE 4-5 PAVEMENT RATING

MATRIX.............................................................................

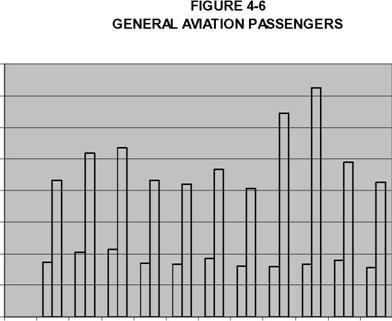

4-33 FIGURE 4-6 GENERAL AVIATION PASSENGERS

.................................................................. 4-57

FIGURE 5-1 AIRFIELD CONCEPT 1

..........................................................................................

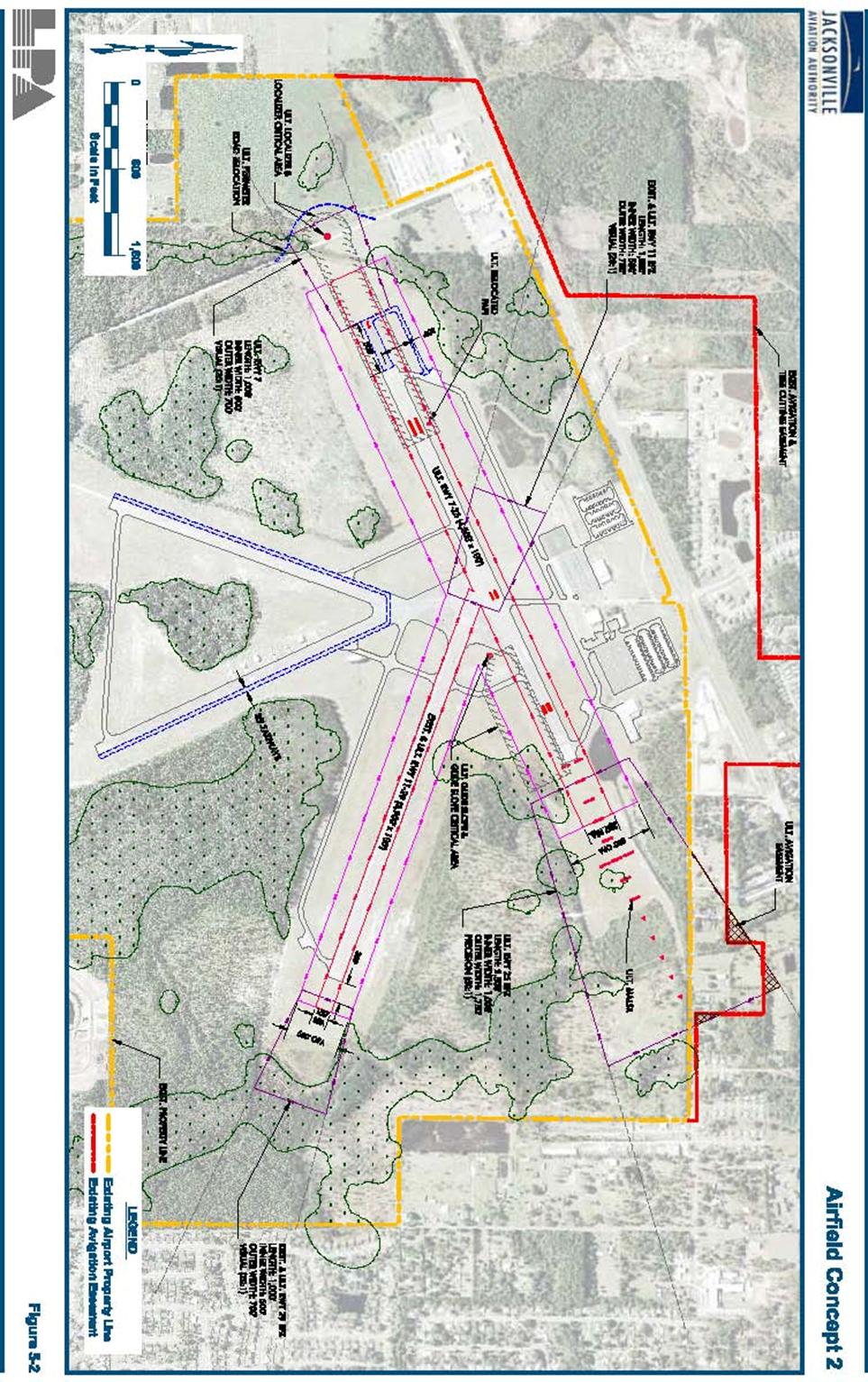

5-16 FIGURE 5-2 AIRFIELD CONCEPT 2

..........................................................................................

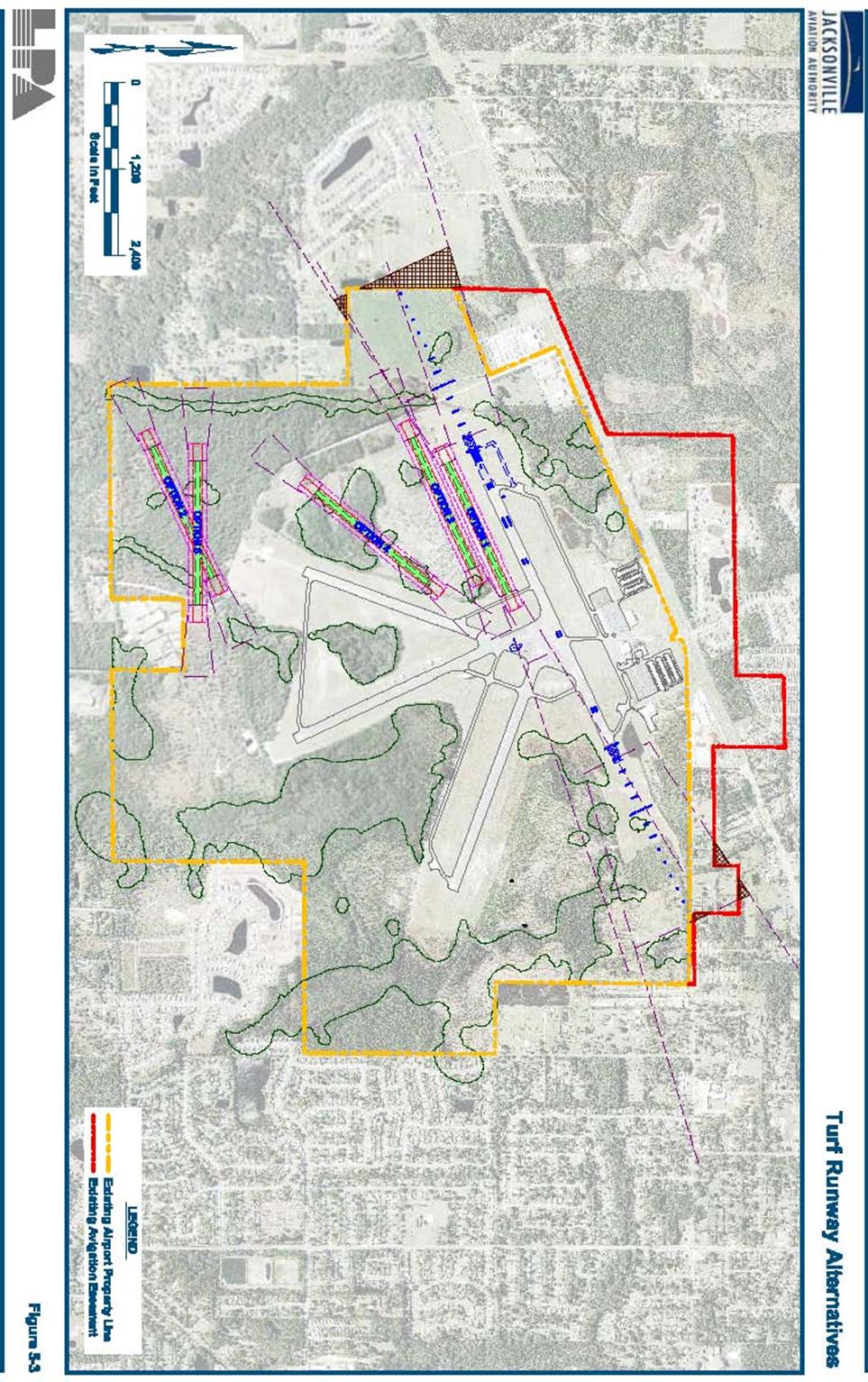

5-20 FIGURE 5-3 TURF RUNWAY ALTERNATIVES

....................................................................... 5-25

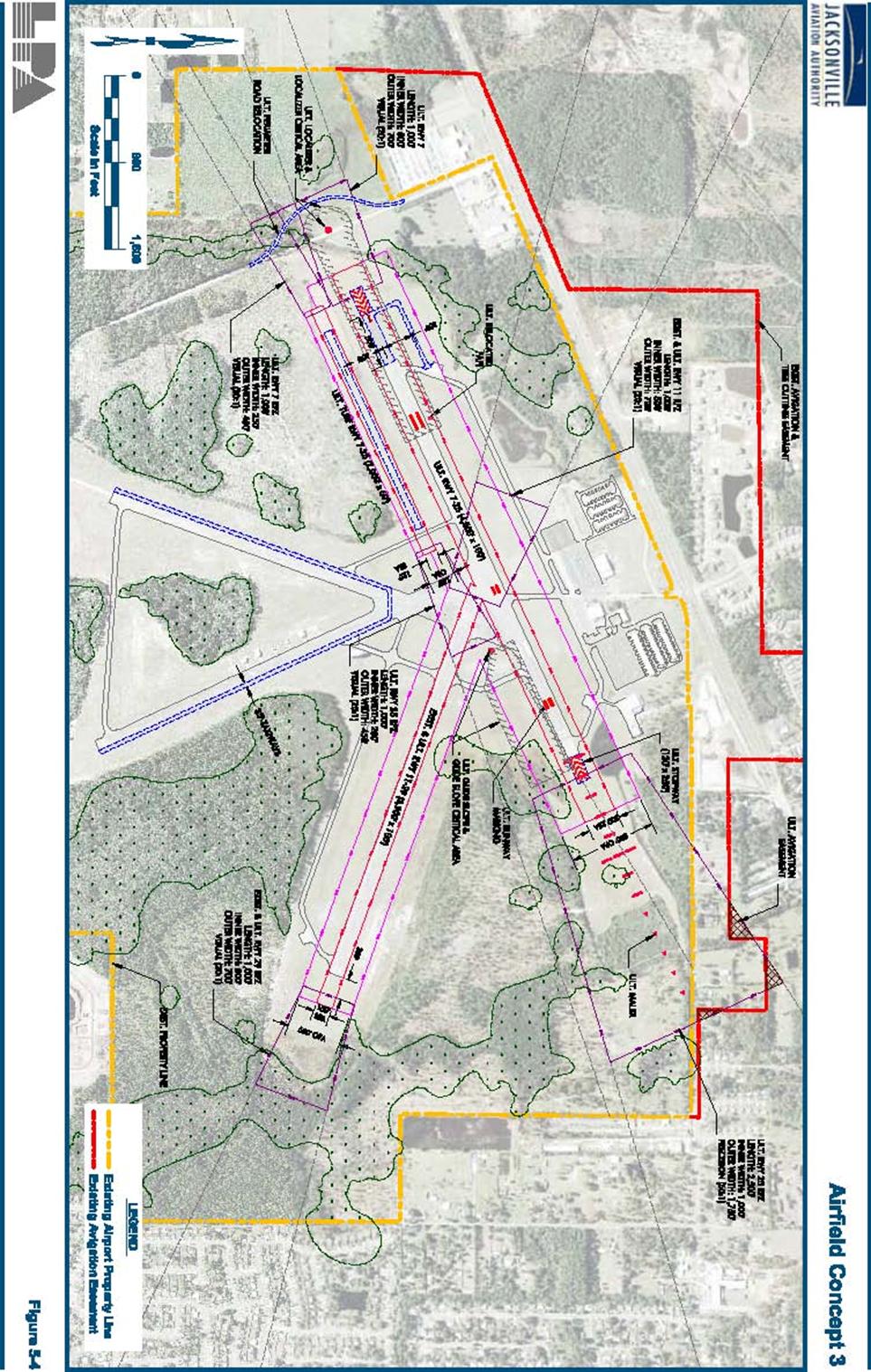

FIGURE 5-4 AIRFIELD CONCEPT 3

..........................................................................................

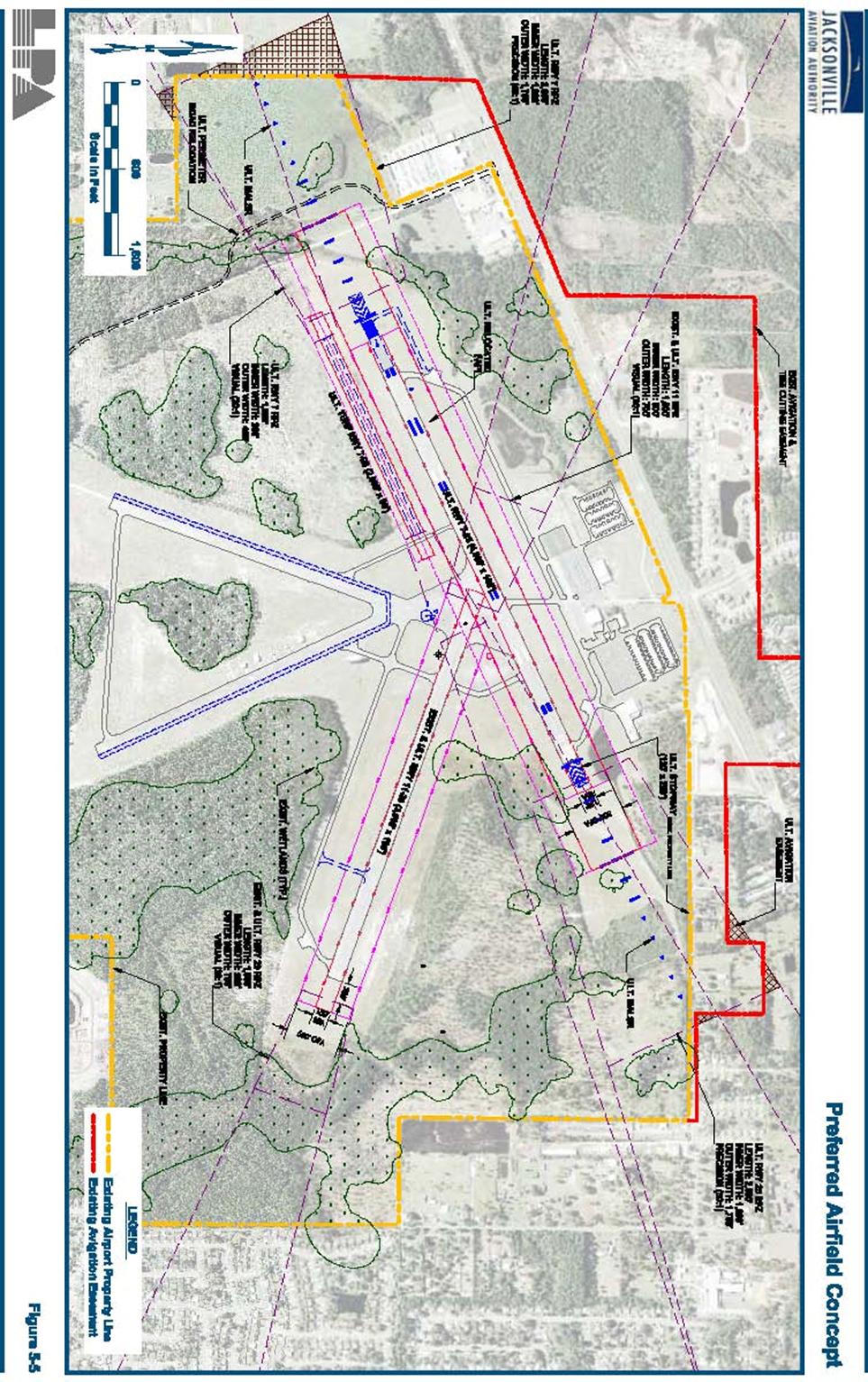

5-27 FIGURE 5-5 PREFERRED AIRFIELD CONCEPT

................................................................... 5-39

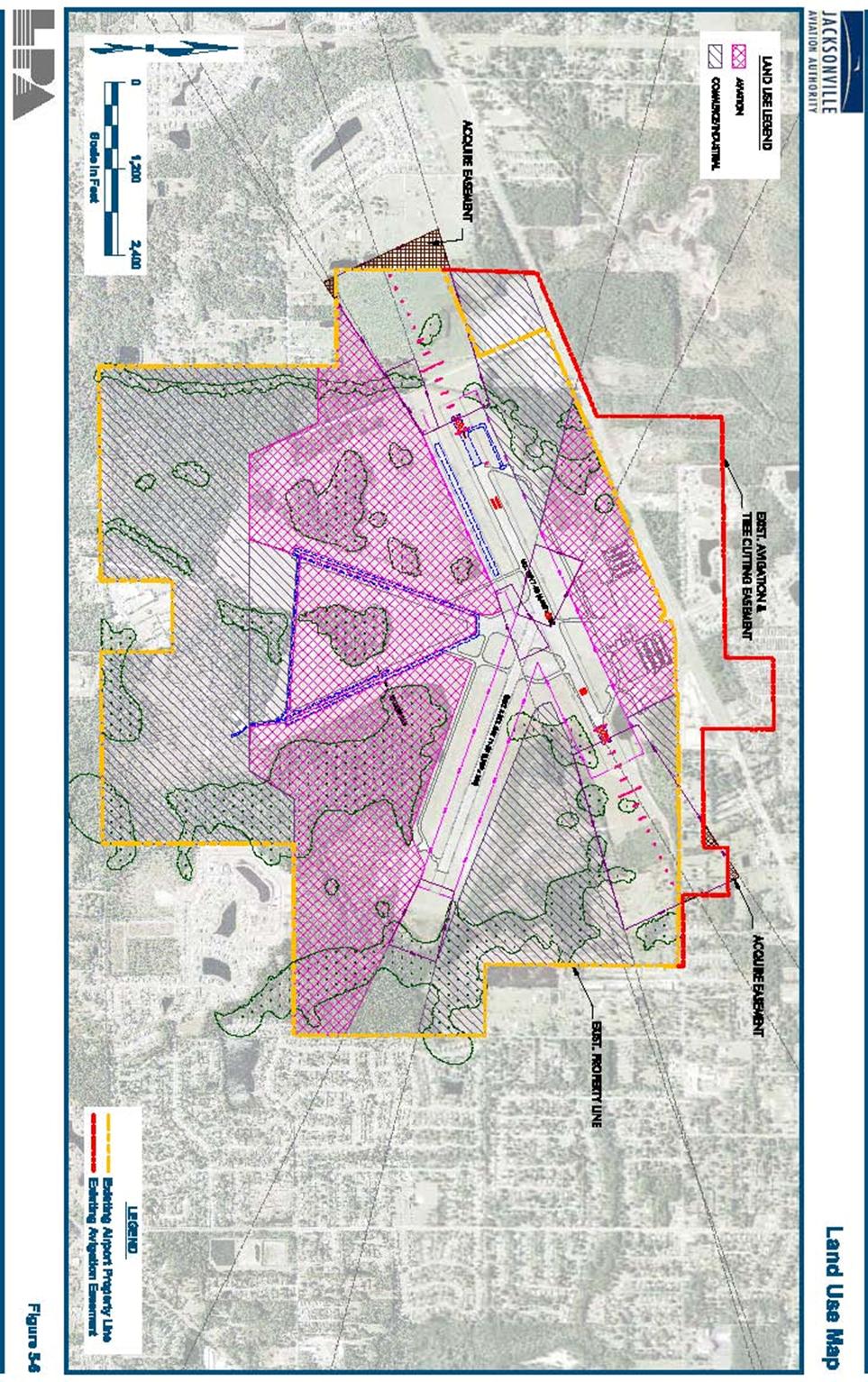

FIGURE 5-6 LAND USE MAP ........................................................................................................

5-40 |

|

|

|

|

|

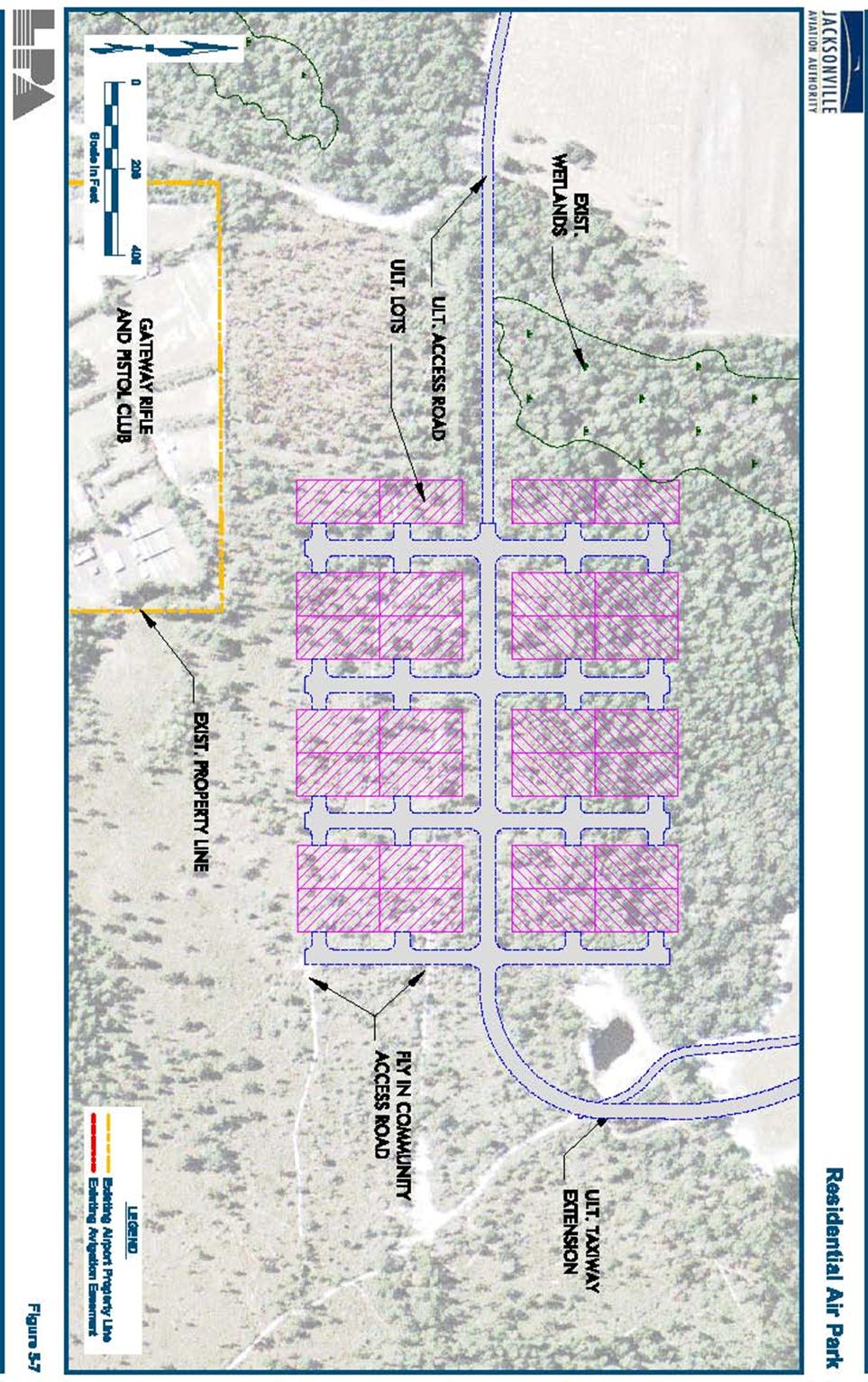

FIGURE

5-7 RESIDENTIAL AIR PARK .....................................................................................

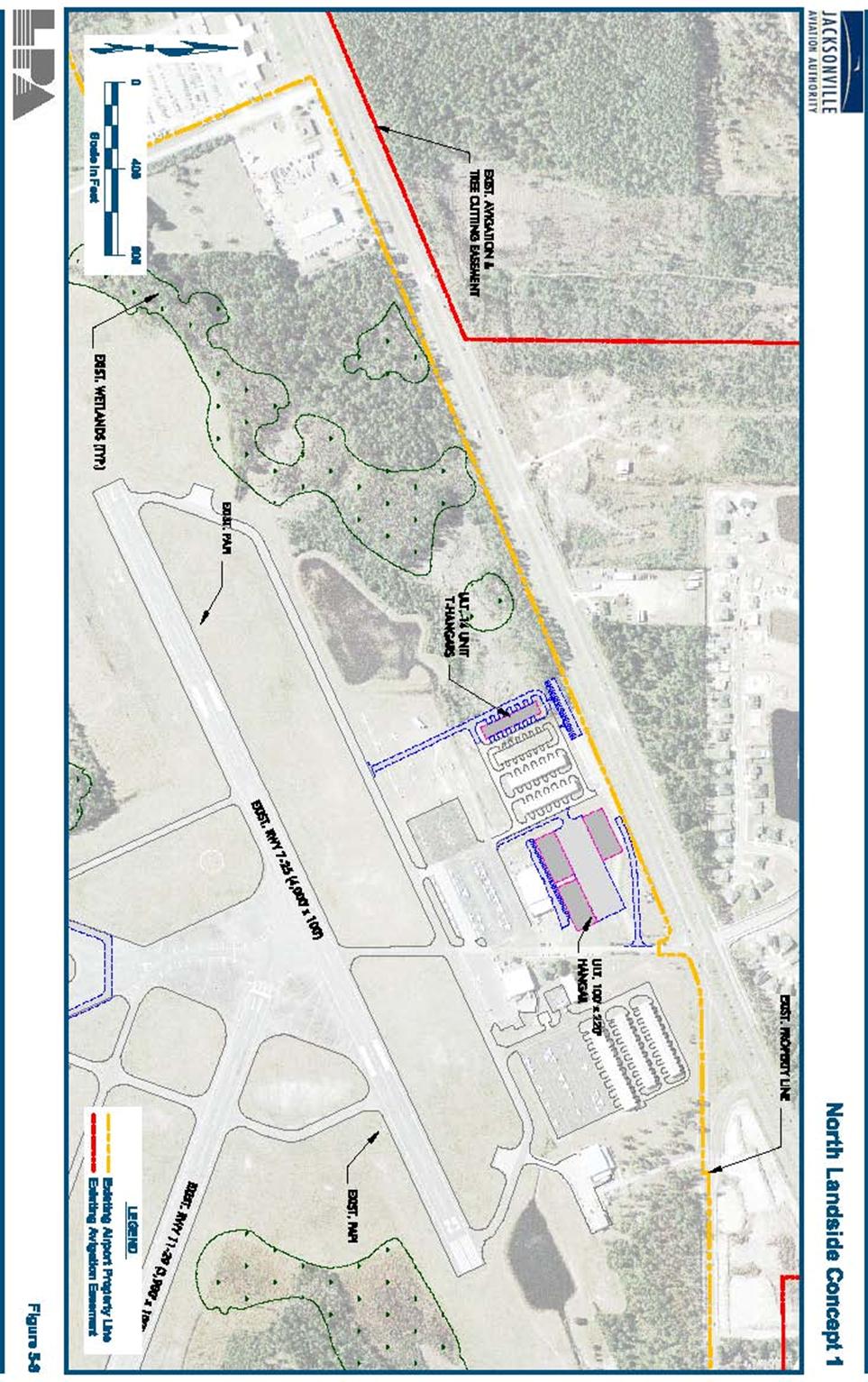

5-45 FIGURE 5-8 NORTH LANDSIDE CONCEPT 1

..........................................................................

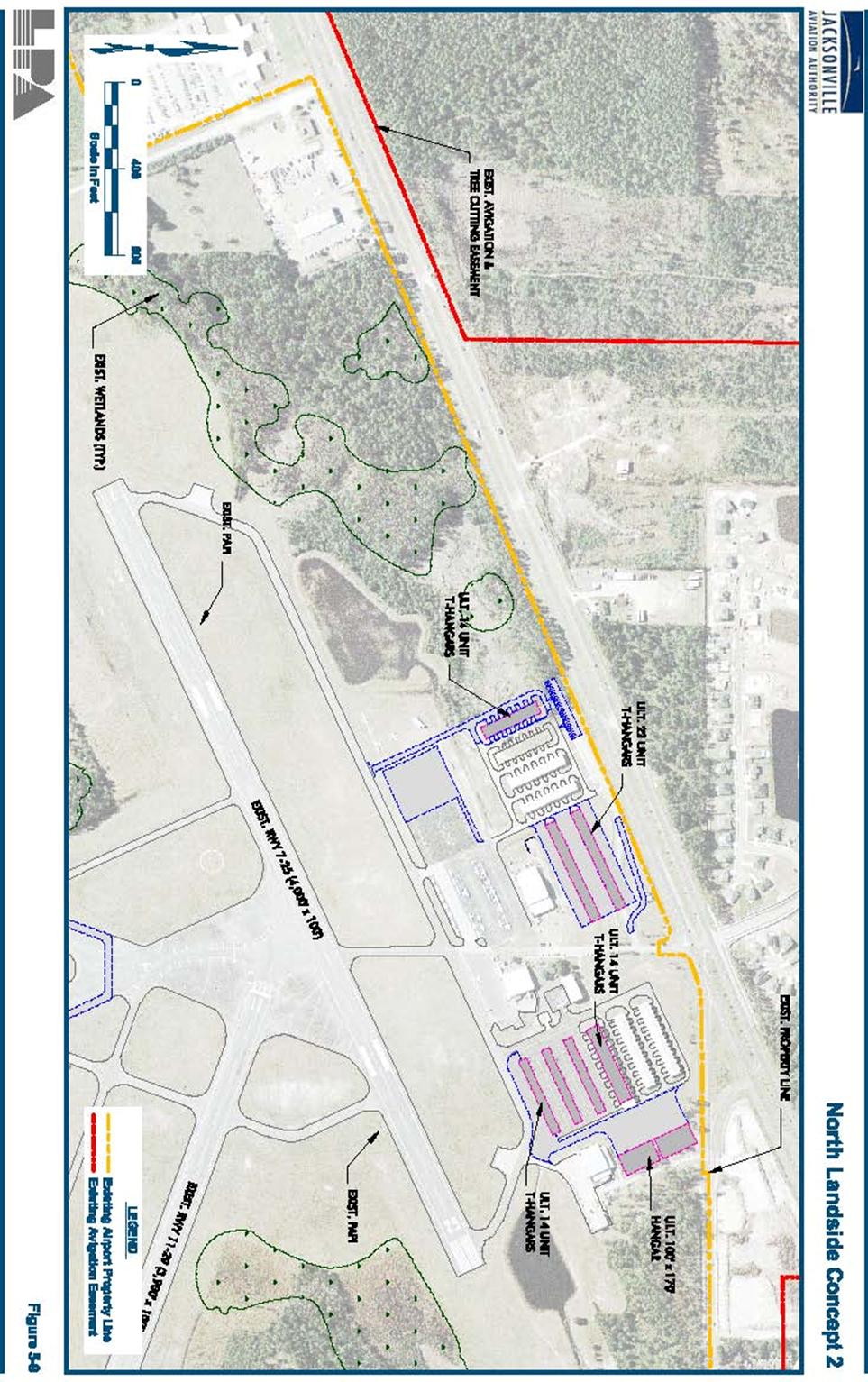

5-53 FIGURE 5-9 NORTH LANDSIDE CONCEPT 2

..........................................................................

5-56 FIGURE 5-10 NORTH LANDSIDE CONCEPT 3

..........................................................................

5-59 FIGURE 5-11 MIDFIELD CONCEPT 1

..........................................................................................

5-65 FIGURE 5-12 MIDFIELD CONCEPT 2

..........................................................................................

5-71 FIGURE 5-13 WEST INDUSTRIAL ZONE

....................................................................................

5-76 FIGURE 5-14 EAST COMMERCE PARK

......................................................................................

5-78 FIGURE 5-15 SOUTH INDUSTRIAL PARK

..................................................................................

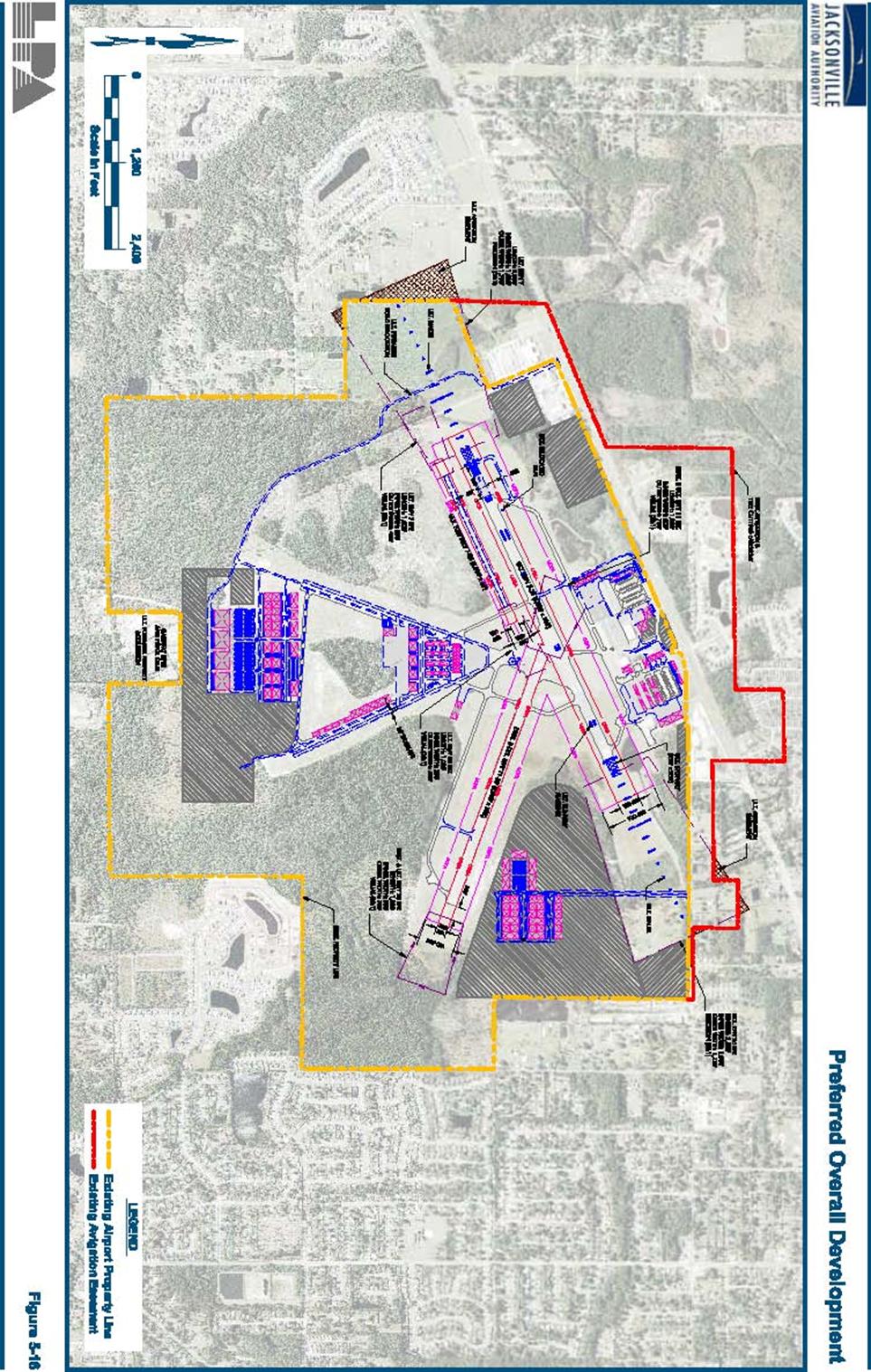

5-82 FIGURE 5-16 PREFERRED OVERALL DEVELOPMENT

......................................................... 5-88 AIRPORT LAYOUT

PLAN COVER SHEET

(1)..............................................................................

6-6 AIRPORT LAYOUT PLAN DRAWING SHEET (2)

........................................................................ 6-7

AIRPORT LAYOUT PLAN DATA SHEET (3)

.................................................................................

6-8 AIRPORT LAYOUT PLAN TERMINAL AREA DRAWING (4) ...................................................

6-9 AIRPORT LAYOUT PLAN INNER APPROACH RUNWAY 7-25 (5)

........................................ 6-10 AIRPORT LAYOUT PLAN INNER

APPROACH RUNWAY 11-29 (6) ....................................... 6-11

AIRPORT LAYOUT PLAN AIRSPACE DRAWING (7)

................................................................ 6-12 AIRPORT

LAYOUT PLAN ON AIRPORT LAND USE (EXISTING)

(8).................................... 6-13 AIRPORT LAYOUT PLAN ON AIRPORT

LAND USE (FUTURE) (9) ...................................... 6-14 AIRPORT

LAYOUT PLAN AIRPORT PROPERTY MAP (SHEET 1 OF 2) (10) ......................

6-15 AIRPORT LAYOUT PLAN AIRPORT PROPERTY MAP (SHEET 2 OF 2) (11)

...................... 6-16 |

|

|

|

|

|

|

|

|

|

|

|

INTRODUCTION |

|

Due to

recent changes at the Airport and areas surrounding its environs, the

Jacksonville Aviation Authority (JAA) undertook an update of the Master Plan

for Herlong Airport (HEG), which was previously updated in 2000. One of the

primary reasons for the update is based upon the Federal Aviation

Administration requirements associated with airports receiving development

grants to conduct periodic updates to their airport development plans. In

addition, Duval County is experiencing a tremendous increase in residential

relocation that has resulted in an increase in construction of residential

and commercial developments around the airport. |

|

GENERAL GUIDELINES |

|

The goal of

the master plan update is to define current and future aviation demand at

HEG, the means and alternatives for addressing this demand, the role of the

airport in the local, regional and national aviation system, and the need for

and financial feasibility of new infrastructure and airport facilities. This

project was funded with grants from the U.S. Department of Transportation

Federal Aviation Administration (FAA), the Florida Department of

Transportation (FDOT) and the Jacksonville Aviation Authority (JAA) and was

programmed to begin in 2005 with completion of the study by the end of 2006. |

|

The airport’s

master plan serves a variety of functions including projecting future

aviation activity and development as a financial planning tool and guiding

on-airport and adjacent land uses. The primary objective of the master plan

update is to create a 20-year development program that will maintain a safe,

efficient, economical, and environmentally acceptable airport facility for

the JAA, City of Jacksonville, and Duval County. By achieving this objective,

the document should provide guidance to satisfy general aviation demand in a

financially feasible and responsible manner. This chapter provides general

direction to the study with respect to the development of concepts and plans

relating to the future development of Herlong Airport. The general approach

is to consider alternative airport development plans, necessary to provide a

“balanced” airport system. |

|

|

|

August 2007 Final

Report |

|

|

|

KEY ISSUES |

|

Overall, this

master plan provides a comprehensive overview of the airport’s needs during

the next 20 years, including issues related to the timing of proposed

development, costs for this development, methods of financing, management

options, and a clear plan of action.

Prior to the start of this master plan update, key issues within the

functional categories of facilities, business, operational, properties and

environmental issues, were identified by Airport Management as requiring

attention, including: |

|

|

|

August 2007 Final

Report |

|

|

|

4

Conduct

review of the land area needs of the airport, and the potential absorption of

land |

|

for aviation related development. 4

Conduct review of land use on and

adjacent to the airport for possible impacts. 4 Consider potential relocation of Gateway NFLE and

Pistol Club. 4 Develop

a current and up-to-date Property Map (formerly Exhibit A). |

|

.

Environmental Issues 4

Provide overview of environmental

factors that may act to limit or guide the development of airport property. 4

Obtain inventory of permitted projects

including existing on-airport ponds. |

|

GOALS AND OBJECTIVES |

|

The overall

goal of the master plan update is to provide HEG with detailed planning

guidance to ensure that Airport facilities and associated land uses will be

adequate to meet short-, intermediate-, and long-term aviation demand. This

document will serve as a management guide for the implementation of necessary

improvements to meet potential aviation activity demand over a planning

period of 20+ years, through the end of 2025. |

|

The key objectives associated with this study

include: |

|

4

Identify

the needed airside, landside, and airspace improvements and recommend options

to further optimize the economic aspects of the airport while enhancing the

safety and operational capability; |

|

4

Establish

an implementation schedule for short-, intermediate-, and long-term

improvements and ensure that they are financially feasible; |

|

4

Identify

short-term requirements and recommend actions to optimize short-term funding

opportunities to be incorporated into the Florida Department of

Transportation (FDOT) Joint Automated Capital Improvement Program (JACIP); |

|

4

Insure

that short-term actions and recommendations do not preclude long-range

planning |

|

options; 4 Incorporate the interests of the public and

government agencies into the planning process; 4 Remain sensitive to the overall environmental

characteristics and needs of the area |

|

surrounding the airport; and 4

Incorporate current comprehensive land

use (both on- and off-airport property) and recommend developments that are

compatible with existing and future land uses. |

|

Therefore, in

order to address the various internal and external factors impacting HEG, a

list of goals was identified based upon the key issues and objectives

impacting HEG in order to provide a guide for the study development. Recommended goals are presented in no

particular order, and, thus, no one goal has priority over the other. |

|

|

|

August 2007 Final Report |

|

|

|

Goal No. 1 |

|

Continue to meet and enhance the level of service

provided to all Airport users. |

|

Objectives: |

|

4 Provide

adequate runway capacity for estimated demand in terms of aircraft type and |

|

annual and hourly operations. |

|

4 Provide

adequate runway length to meet existing and forecast operations needs. |

|

4

Provide opportunities for development

of services associated with potential charter and |

|

corporate GA,

military, flight training, and recreational flying operations. |

|

4 Provide

for potential integration of military and non-military operations. |

|

4

Provide other aviation related support

facilities required for a full range of aviation |

|

services. |

|

4 Provide insight into the estimated future needs of hangar facilities.

|

|

Goal No. 2 |

|

Provide

guidelines for future development, while satisfying anticipated demand. |

|

Objectives: |

|

4 Implementation of non-aviation development to enhance revenue

diversification. |

|

4 Provide

adequate airside and landside facilities to meet anticipated demand. |

|

4 Effectively

market potential commercial and non-commercial aviation facilities. |

|

4

Develop self-sustaining commerce and/or

industrial parks, which will benefit the Airport |

|

and community as a whole. |

|

4

Develop a schematic for incorporating 3rd party

funding for future development. |

|

|

|

August 2007 Final

Report |

|

|

|

Goal No. 3 |

|

Provide an Airport that is safe and reliable. |

|

Objectives: |

|

4

Provide

navigational aids (NAVAIDS) including global positioning system (GPS) and

non-GPS approach options, flight support services, and meteorological

facilities, which enhance the safety and reliability of operations under all

weather conditions. |

|

4

Protect

FAA mandated safety areas, runway protection zones (RPZs), and other clear |

|

zones. 4 Minimize possible obstructions to air navigation. 4

Provide adequate fire fighting, rescue

and emergency services, access roads, facilities, |

|

equipment, and personnel to maintain minimum

response time under all conditions. 4 Ensure that airside and landside operations and

facilities meet all applicable security |

|

standards. 4 Ensure that aircraft parking facilities are

adequately sized and easy to negotiate. 4 Develop facilities to meet the demands of the

current and future critical aircraft. 4 Address the need and timeline for a control tower

with the expected development of the |

|

SATS and Air Taxi segments of the industry. |

|

Goal No. 4 |

|

Develop the Airport and its vicinity to minimize

negative environmental impacts. |

|

Objective: |

|

4 Identify

the major environmental issues of concern. 4

Minimize potential

environmental impacts, and provide special attention to minimizing noise

impacts, air and water pollution, and wetland impacts. |

|

4

Consider

the use and development of airport property to minimize any adverse impacts

on other environmental concerns while maintaining a safe environment for

users and adjacent land owners (i.e. timber harvesting and wildlife

control). |

|

4

Design

and select noise abatement measures that minimize the number of people

exposed to noise above Day-Night Noise Level (DNL) greater than 65 decibels,

if applicable. |

|

4

In

selecting noise abatement actions, avoid actions that would adversely affect

capacity, impose restrictions on Airport use that would be discriminatory, or

that could erode prudent margins of safety. |

|

4

When

necessary, encourage local construction restrictions to reduce impact of

Airport/aviation. |

|

|

|

August 2007 Final Report |

|

|

|

Goal No. 5 |

|

Promote the development of compatible land use in

undeveloped areas within the Airport vicinity. |

|

Objectives: |

|

4

Promote

land use planning and development objectives, for on- and off-Airport land

use, which are compatible with the anticipated long-range needs of the

Airport and the community as a whole. |

|

4

Designate areas for future development

hangar homes, maintenance, commerce park, etc. 4 Locate Airport facilities so that growth may be

controlled through land-use planning and zoning. 4

Consider the impacts of the Gun Club on

Airport Operations. |

|

Goal No. 6 |

|

Develop an

Airport that supports local and regional economic goals while accommodating

new opportunities or shifts in development patterns. |

|

Objectives: |

|

4

Achieve

a level of service and user convenience such that the Airport is a positive

factor in regional economic development decisions. |

|

4

Achieve

capacities of the airfield, the terminal area systems, and industrial

park/Commerce Park, so that the Airport may be an attractive location for GA,

maintenance, and other aviation related activities. |

|

4

Provide

appropriate and achievable commercial opportunities adjacent to and on the

Airport. |

|

4

To

assure economic feasibility, identify an equitable distribution of user

charges; distribute the burden of capital investment, maintenance, and

operating costs, while keeping overall costs within an acceptable level. |

|

4

Identify

financial alternatives and funding sources available for the implementation

of |

|

aviation and non-aviation projects. 4

Quantify financial resources available

for project funding. 4 Develop

an airport layout plan (ALP) that easily integrates with existing and

proposed |

|

transportation

infrastructure, to encourage economic growth. |

|

|

|

August 2007 Final Report |

|

|

|

Goal No. 7 |

|

Minimize

aircraft delay associated costs to all airfield users (i.e. military

operations, recreational pilots, experimental aircraft, flight training

facilities, etc.). |

|

Objectives: |

|

4

Minimize

airspace congestion and delays for GA aircraft through procedural changes

and/or provision of additional NAVAIDS. |

|

4 Minimize airside congestion through construction of

runways, taxiways, and aprons, when the costs of providing the additional

capacity are less than the additional operating costs associated with aircraft

delays. |

|

Goal No. 8 |

|

Ensure

adequate and convenient ground access to the Airport. |

|

Objectives: |

|

4

Provide safe access and easy-to-follow

signs to Airport roadways and facilities. 4 Provide adequate lane capacity on roads leading to

the Airport, to serve existing and future activity. 4

Provide adequate land capacity on

internal circulation roadways serving functional areas (terminal, GA,

commerce park, etc.). 4 Provide

parking facilities (for GA, terminal, commerce park, etc.) that are

conveniently located and easily accessible. 4 Maintain close coordination with Regional Planning

Council, Metropolitan Planning Organizations (MPO), FDOT, and other

transportation groups. |

|

These goals

and objectives reflect policy goals to be reached through the master planning

process. They include the ultimate development of self-supporting facilities

to serve the existing and future aviation needs of the region; the

achievement of compatible land uses in the vicinity of the Airport; and

provisions for the type of development that will yield the most public

benefit of the investment represented by the Airport. Finally, these goals

must be manageable within existing limitations of funds and design

principles. |

|

As noted, the

airport is located within a residential populated area and, therefore, any

future developments identified in this study will consider potential

community impacts. Considering this,

to ensure community and government participation in this study, a Technical

Advisory Committee (TAC) |

|

|

|

August 2007 Final Report |

|

|

|

was created

to provide technical review of the working papers and to provide input into

the entire master plan process. The committee was assembled by Airport

Management and includes representatives from JAA, FAA, FDOT, City of

Jacksonville, Duval County, airport tenants and the public/community.

Multiple opportunities will be available for community and governmental

representatives to participate in this study, including through

representatives serving on the study’s technical advisory committee and

through three public meetings held in conjunction with the CPAC

meetings. It is important to note that

the study results and the future developments presented in this report

represent a plan to guide the Jacksonville Aviation Authority in meeting

demand as they develop; therefore, no development should be undertaken until

there is a clearly identified need for it. |

|

REGULATORY GUIDELINES |

|

This Master Plan

is prepared in accordance with Federal Aviation Administration (FAA) Advisory

Circulars AC 150/5370-6B, Airport Master Plans, and AC

150/5300-13, Change 10, Airport Design, in

conjunction with the FDOT’s Guidebook for Airport Master Planning and

other related standards. Furthermore, current guidance will be incorporated

from the FAA Airports District Office (Orlando), FDOT Aviation Office, JAA,

and other local government agencies. Planning efforts of the city, county,

region, state, and nation have been coordinated in the Master Plan to provide

the most preeminent plan for the benefit of HEG and all of the participating

organizations. |

|

In addition,

in order to assist JAA in considering the environmental factors that may

impact future development at HEG, the following national, state and local

legislation was considered. This

overview of regulatory guidelines will assist the sponsor and the planning

consultant in developing alternatives that are tailored to the airport’s

size, unique setting and operating environment while also considering the

airport’s environmental setting, the identification of environmentally

related permits and the potential impacts of recommended development

projects. An in-depth analysis of

existing environmental conditions at HEG is provided in Chapter Two, Inventory

of Existing Conditions. |

|

Water Quality |

|

Legislation |

|

The Federal

Water Pollution Control Act, as amended by the Clean Water Act provides the

authority to establish water control standards, control discharges into

surface and subsurface waters, develop waste treatment management plans and

practices, and issue permits for discharges and for dredged and filled

materials into surface waters. The

Fish and Wildlife Coordination Act requires consultation with the United

States Fish and Wildlife Service (USFWS) and the Florida Fish and Wildlife

Conservation Commission (FFWCC) when any alteration and/or impounding of

water resources is expected. The Federal National Pollution Discharge

Elimination System (NPDES) permit program provides regulations that govern

the quality of stormwater discharges into water resources of the United

States. |

|

|

|

August 2007 Final

Report |

|

|

|

Regulatory Agencies |

|

The United

States Army Corps of Engineers (COE), the Florida Department of Environmental

Protection (FDEP), and the Saint Johns River Water Management District

(SJRWMD) have jurisdiction over and regulate activities that alter the

landscape and disrupt water flow to wetland areas and surface waters through

the Environmental Resource Permitting (ERP) Program in Florida. The program

forwards permit applications to other state and federal agencies including

the FFWCC and the USFWS. Permitting

requirements for construction that exceeds five acres are specified by NPDES

regulations and administered by the FDEP.

|

|

Historical, Architectural,

Archaeological, and Cultural Resources |

|

Legislation |

|

The National

Historic Preservation Act of 1966 and the Archaeological and Historic

Preservation Act of 1974 provide protection against development impacts that

would cause change in historical, architectural, archaeological, or cultural

resources. |

|

Regulatory Agencies |

|

The

Department of State, Division of Historical Resources is responsible for

promoting historical, archaeological, museum, and folk culture resources in

Florida. |

|

Biotic Communities |

|

Legislation |

|

The Fish and

Wildlife Coordination Act (48 Statute 401 as amended; 16USC et. Seq.)

considers impacts to habitat and wildlife.

Section 2 of this act requires consultation with USFWS, the United

States Department of the Interior (USDI), and state agencies that regulate

wildlife whenever water resources are modified by a federal, public, or

private agency under federal permit of license. |

|

Regulatory Agencies |

|

The USFWS

and FFWCC have authority under the act to provide comments and

recommendations concerning vegetation and wildlife resources. |

|

|

|

August 2007 Final

Report |

|

|

|

Endangered and Threatened Species |

|

Legislation |

|

The

Endangered Species Act of 1973 (ESA), as amended, requires federal agencies,

in consultation with and assisted by the USFWS, to ensure that their actions

are not likely to jeopardize the continued existence of listed species or

result in the destruction or adverse modification of critical habitat of such

species. Section 7 of the Act states

that federal agencies must review their actions: If those actions will affect

a listed species or its habitat, they must consult with the United States

Fish and Wildlife Service. |

|

Regulatory Agency |

|

The USFWS,

the Florida Department of Agriculture and Consumer Services (FDACS), and the

FFWCC have jurisdiction over and administer native endangered and threatened

species permits for Florida. During the consultation process, the USFWS will

determine the significance of potential impacts to federally protected

species and will recommend methods to avoid or mitigate for impacts that may

occur as a result of the proposed projects.

|

|

The FFWCC

Threatened and Endangered Species Section reviews and issues permits that

involve Florida’s protected terrestrial animal species. The FFWCC Bureau of Protected Species

Management reviews and issues permits that involve Florida’s protected

aquatic wildlife species. The FDACS Division of Plant Industry is responsible

for providing protection to Florida’s protected native plant species that are

classified as endangered, threatened, or commercially exploited. |

|

Wetlands |

|

Legislation |

|

Executive

Order 11990, Protection of Wetlands, mandates that each federal agency take

action to minimize the destruction, loss, or degradation of wetlands, and

preserve and enhance their natural values. On the federal level, wetlands are

regulated according to Section 404 of the Clean Water Act, which requires a

permit for dredging and filling activities that take place in Waters of the

United States, including wetlands. |

|

The legal

framework for the regulation of activities in wetlands by the State of

Florida and by the State’s Water Management Districts is provided, in part,

by Chapter 373 of the Florida Statutes, the Florida Water Resources Act of

1972, specifically 373.414 which states that an activity regulated under

this part will not be harmful to water resources; water quality standards

will not be violated; and such activity in, on, or over surface waters or

wetlands, is not contrary to the public interest. If such an activity significantly degrades

or is within an Outstanding Florida Water, the applicant must |

|

|

|

August 2007 Final

Report |

|

|

|

provide

reasonable assurance that the proposed activity will be clearly in the public

interest. Specifics concerning permit requirements are codified in Chapter

40, parts A through E, of the Florida Administrative Code. |

|

Regulatory Agencies |

|

In Northeast

Florida, the COE, the FDEP, and the SJRWMD have jurisdiction over and

regulate activities that alter the landscape and disrupt water flow to

wetland areas and surface waters through the State ERP Program. |

|

Floodplains |

|

Legislation |

|

Executive

Order 11988, “Floodplain Management” defines floodplains as lowland areas

adjoining inland and coastal waters, especially those areas subject to one

percent or greater chance of flooding in any given year. |

|

Regulatory Agencies |

|

The Federal

Emergency Management Agency (FEMA) has produced Flood Insurance Rate Maps

(FIRMs) for communities participating in the National Flood Insurance

Program. The maps detail the 100-year

and 500-year base flood elevations. The State of Florida administers and

requires compensation for floodplain impacts through the ERP program. SJRWMD has jurisdiction over Northeast

Florida. |

|

Coastal Zone Management Program |

|

Legislation |

|

The Coastal

Zone Management Act (CZMA) aims to preserve, protect, develop, and where

possible, restore and enhance the resources of the nation’s coastal

zone. The Florida Coastal Management

Act of 1978 (Chapter 380, Part II, Florida Statutes) authorized the FDEP to

develop a comprehensive state coastal management program based upon existing

Florida Statutes and Rules. |

|

Regulatory Agency |

|

The FDEP is

responsible for directing the implementation of the Florida Coastal

Management Program (FCMP). The program

is based on a cooperative network of nine agencies including the FDEP, the

Florida Department of Community Affairs (DCA), FFWCC, Department of State

(DOS), Governor’s Office of Planning and Budgeting (OPB), Department of

Transportation (DOT), |

|

|

|

August 2007 Final

Report |

|

|

|

Department of

Health (DOH), and the Division of Forestry within the DACS. SJRWMD is also a cooperating member in the

consistency review process for Northeast Florida. |

|

Farmland |

|

Legislation |

|

The Farmland

Protection Policy Act of 1981 (FPPA) requires the evaluation of farmland

conversion to non-agricultural areas. Prime farmland is land best suited for

producing food, feed, forage, fiber, and oilseed crops. This land has the

quality, growing season, and moisture supply necessary to produce sustained

crop yields with minimal energy and economic input. |

|

Regulatory Agencies |

|

The National

Resources Conservation Service (NRCS) has jurisdiction and should be

consulted if farmland is to be converted to non-agricultural use by a

federally funded project. The

consultation determines whether the farmland is classified as “prime” or

“unique.” If it is, the Farmland

Protection Act requires rating the farmland conversion impacts based upon the

length of time farmed, amount of farmland remaining in the area, level of

local farm support services, and the level of urban land in the area. |

|

MASTER PLANNING PROCESS |

|

The Master

Plan provides an effective written and graphic representation of the ultimate

development of the Airport and associated land uses adjacent to the Airport,

while establishing a schedule of priorities and phasing for the various

improvements proposed. The planning document presents a conceptual

development plan, over a 20+-year period, for the Airport. Realistic master

planning is a continuing and evolutionary process due to the justification

and funding required during the implementation process. Many adjustments are

likely to take place to meet the changing industry before facilities are designed,

approved, and built to completion. |

|

An approved

Airport Master Plan provides long-range recommendations for development of an

airport and is essential for an airport to qualify for federal and/or state

assistance for realization of the plan. Government assistance is provided in

the form of financial grants to the airport sponsor. The grants are provided

by the FAA through the Airport Improvement Program (AIP) funded by the

Federal Aviation Trust Fund and by the FDOT through the Aviation Fuel Tax that

funds approximately 60 percent of the State Aviation Program and through the

Public Transportation Fund for the remaining 40 percent. |

|

This master

plan update provides a systematic outline of the development actions required

to maintain and further develop airfield and landside facilities. This process provides the officials

responsible for |

|

|

|

August 2007 Final

Report |

|

|

|

scheduling,

budgeting and ultimate funding of airport improvement projects with an

advance notice of the future needs of the Airport. By phasing airport

improvements, the development can be conducted in an orderly and timely

fashion. |

|

To accomplish

the objectives identified, the study included the following tasks: |

|

4 Conduct

an inventory of existing documents related to the airport, the physical

airport facilities, demographics of the airport service area, and airport

environment; 4 Collect historical operational

data, conducting tenant interviews, and forecasting aviation activity through

the year 2025; |

|

4

Conduct

a comprehensive analysis of current airport facilities, determination of

trends and activities affecting the airport, the identification and analysis

of potential trends in the aviation industry including potential impacts to

future operations; |

|

4 Evaluate

and compare the airfield capacity to expected aviation activity; 4 Determine

the airport facilities required to meet forecast demand; 4 Create

a concise Airport Layout Plan (ALP) drawing set reflecting the proposed |

|

improvements throughout the master planning time

period 4 Compile a schedule of the

proposed improvements, including cost estimates, phasing and financial